Online banking has made electronic payments fast and easy. But even in these modern times, many people and businesses use paper checks. And when you’re paid by check, you need to endorse it before you deposit it.

But how do you endorse a check? Our team here at Remitly has put together this guide to help you learn how to endorse a check.

What does it mean to endorse a check?

In most cases, “endorsement” simply means that you need to sign the back of the check before you can deposit or cash it.

There are, however, a few different ways to endorse a check, depending on how you want to use it. For instance, you can:

- Endorse the check to sign it over to a third party

- Endorse a check for the benefit of another person

- Endorse a check for a business

- Endorse a check for a certain kind of deposit, like mobile banking

While the steps for endorsing a check are very similar in most countries, there are some differences. In this article, we will just focus on how to endorse a check in the U.S.

How to endorse a check

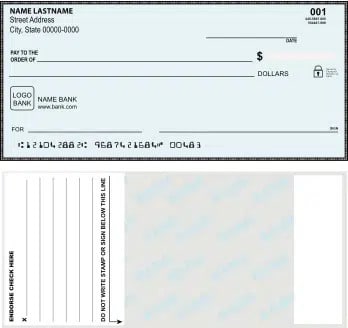

First, find the endorsement area on the back of the check. You’ll see language such as “Endorse check here” and three lines. Most checks indicate “do not write” below that endorsement area.

To endorse the check, sign your name within the endorsement area.

This is known as a blank endorsement, but other types of endorsements may change the steps you need to take when endorsing a check.

The types of endorsements

You can use three main types of endorsements: a blank endorsement, a restrictive endorsement, or a full endorsement. Each type will change how you endorse the check.

1. Blank endorsement

A blank endorsement is the most common way to endorse a check. A check holder (or payee) who wishes to make a blank endorsement can just sign the endorsement area of the check, indicating that they accept the transfer of the funds.

2. Restrictive endorsement

To complete a restrictive endorsement, sign the check in the endorsement area as usual and then write the words “for deposit only” underneath your signature. This means the check will not be cashable at a cash counter, and you can only deposit the funds into a bank account.

You may also include a specific bank account number to ensure the check can only be deposited into a specific account. You can also write “for mobile deposit only” if you wish only to be able to cash the check via mobile deposit through your personal banking app.

A restrictive endorsement can be used as a security measure to prevent someone else from cashing a check you’ve endorsed.

3. Full endorsement

A full endorsement is the same as a third-party check endorsement, which we will discuss in greater detail below. You must endorse the check next to the words “Pay to the order of” and the name of the person you’re transferring the check to.

How to endorse a check in different situations

Let’s look at examples of the three types of endorsements in action. How you choose to use the check will determine the type of endorsement you need.

Depositing or cashing a check at the bank

Whether you want to deposit a check into your checking account or savings account or you want to cash a check, you can do so in person at the bank. In this situation, use a blank endorsement.

When you go into a bank with the check, you can turn over the check and sign the back of it in front of the bank teller. That signature tells the bank that you have accepted the check and approved the money for deposit into your account.

If a check does not have the right endorsement or any at all, you may be unable to access the funds. A bank or credit union may also flag an unendorsed check as fraudulent, which could delay you getting your money.

If you are going to deposit or cash your check in person, wait to endorse the check until you’re at the bank. If you endorse the check in advance, someone else could take the funds if the check falls into their hands.

Depositing a check through the ATM or night drop

In the 21st century, only a few of us often go into a bank to deposit checks. ATMs and night drops have become popular alternatives to seeing a teller.

To endorse a check to deposit in the ATM, you can usually simply sign your name on the line on the back. However, defer to any check endorsing instructions that appear on the screen.

You can endorse a check for the night drop box the same way. The biggest difference is that you should typically fill out a deposit slip with your account number when you use the night drop, while you don’t need to do so for an ATM deposit.

Signing a check over to a third party

Instead of depositing or cashing the check yourself, you can sign a check over to another person. In this situation, you will use a full endorsement, also known as a special endorsement or a third-party check endorsement.

In addition to signing the back of the check, you will also write “pay to the order of” and the first and last name of the person you’re transferring the check to. Essentially, you’re transferring the check’s funds to someone who is neither the person that wrote the check (the first party) nor the original payee (the second party).

For a third-party endorsement to work, the bank or other financial institution must know the original payee (you as the second party) approves the payment of the money to the third party.

When you sign over a check to a third person, you need to realize that the check funds will no longer be going to you but to the person you name in the endorsement. For this reason, you need to be clear about what’s happening and only use a third-party endorsement with people you trust.

Keep in mind that what someone can do with signed-over checks is limited. Most businesses won’t accept third-party checks as payment for goods and services. However, you can typically submit third-party checks for cash or deposit at a financial institution.

Making a business endorsement

If you need to endorse checks to cash for your business or deposit into your business’s bank account, the process is slightly different than it is for personal checks.

The first step is to write the business’s name on the back of the check. Be sure to write the name exactly as it appears on the “pay to the order of” line.

Below that, sign your name. Then, write your company title, such as President or Owner, on the third line. If you wish, you can also add a restrictive endorsement like “for deposit only” to the back of the business check.

To prevent check fraud, the bank may verify to see that you’re an authorized signer on the business checking account. If you’re cashing the check rather than depositing it into a bank account, you may be asked to show photo identification as well.

Endorsing a check made out to multiple people

Endorsing a check is straightforward if you’re the only person listed on the “pay to the order of” line. The process becomes a little more complicated if two or more people’s names appear there.

How to endorse a check made out to multiple payees depends on what the check writer put on the front of the check. If the names are connected by the word “and,” as in Jim and Marsha Smith, banks usually require both parties to sign the back of the check before cashing it.

You may run into this issue when you and your partner receive a paper check from the IRS or another government agency.

Should the other person not be available to endorse the back, most banks will allow you to endorse the back with “for deposit only” and then deposit the check into an account. However, the account must usually be a joint checking or savings account that belongs to both of you.

Many banks will only require one person to endorse a check if the names on the pay to the order of line are connected with an or, such as in “Jim or Marsha Smith.”

Doing a mobile endorsement for a virtual deposit

Many banks now allow you to deposit checks without leaving home. With a mobile banking app, you can deposit a check simply by photographing it, provided you endorse it properly.

To make a mobile endorsement, simply sign the back of the check with the words “for mobile deposit only.” Once you deposit a check remotely, retain it until you see the deposit posted to your account.

What else do I need to know about how to endorse a check?

Here are some final tips for endorsing checks.

Double-check everything before you endorse a check

Before you endorse it, you must ensure that the original check has the correct date, amount, and payee name. Also, confirm that the person has filled out the signature line.

To protect yourself from fraud, ensure the fund amount in the right-hand box in numbers matches the amount written out on the second line in the middle. Have the person write you a new check if there are any errors.

If there is a discrepancy in the written-out and numerical amounts, or if something is illegible, the check may not be honored. The recipient can only cash the check if the information on the front of the check is correct.

Spelling counts

If your name isn’t spelled properly on the payee line, the bank may still allow you to cash or deposit it if you endorse it properly. Typically, the right approach is to first sign your name with the incorrect spelling on the back and then sign it again with the actual spelling on the second line.

Submit checks for cash or deposit as soon as you can

In most cases, checks have a lifespan of six months. This means if the date is miswritten, or it appears as though the check is more than six months old, the recipient cannot cash it. Errors in the payee’s name will also prevent you from cashing the check.

Use the right color ink

When you endorse checks, use blue or black ink, as other colors may not be readable by the scanners at banks and credit unions.

Double-check with your financial institution

Not all banks have the same rules for check endorsements. As a result, it’s wise to get endorsement instructions from your bank or credit union before you endorse the back of the check.

It is easy to learn how to endorse a check. As with all other banking matters, though, attention to detail counts. If you fail to endorse a check correctly, you may not get the money you need on time or even get it at all!