Do you have to void a check but aren’t sure how to go about it? You’ve come to the right place.

When it comes to personal finance, there may be several reasons why you need to know how to void a check associated with your bank account number. Read this guide created by our team here at Remitly to learn how to safely void a check without risking the safety of your bank account.

Reasons for using a voided check

You may need to know how to void a check for several reasons. Here is a closer look at why you might need to void paper checks:

1. Automatic bill payments

If you want to set up automated electronic payments for bills, the service provider may ask for a voided check. This verifies your identity with a credit union or bank and ensures the bank account number from which the funds will be withdrawn gets recorded correctly.

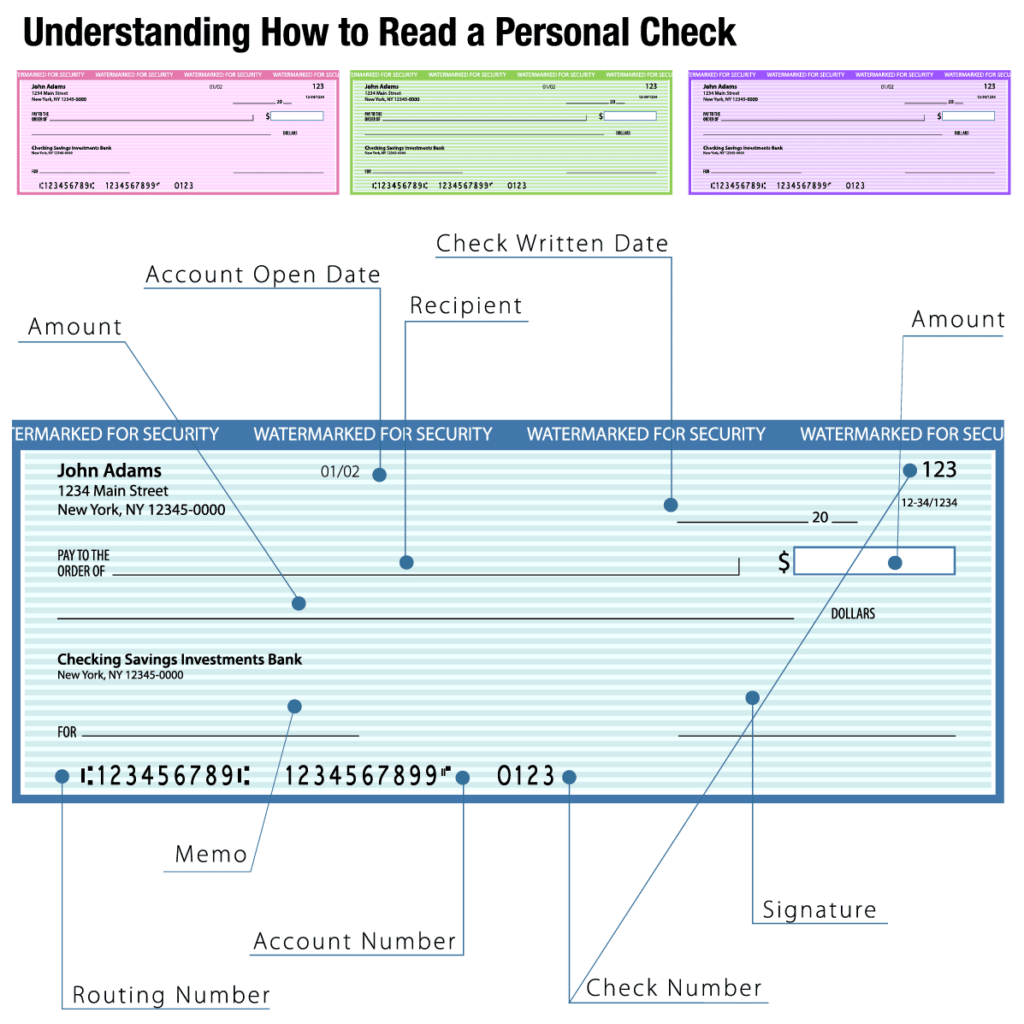

To make automatic payments, you need your institution, branch number, and bank routing number. You can find this information at the bottom of your check. A voided check helps companies that make deductions for automatic payments avoid problems caused by user errors.

Without a voided check, you may have entered your checking account number incorrectly. If someone else has the same account number as the incorrect entry, the wrong person may end up being debited.

Once the company you wish to pay has this information, the funds can be directly withdrawn from your account. This way, you won’t have to mail a check or use your credit card.

2. Direct deposit setup

If you’ve started a new job, your employer will likely pay you through a bank account. Many employers ask for a voided check to ensure no errors in recording your bank account information.

They may also ask you to fill out a direct deposit authorization form. This ensures there are no delays in receiving your payment.

After receiving your weekly pay, you’ll receive a deposit slip to confirm. Direct deposits are another element of online banking that can simplify your finances and are much quicker than check payments.

3. Error on the check

If you’ve made an error on a check you’re filling out, void it before tossing it away. The check may still be cashable if it falls into the wrong hands.

For example, let’s say you write a check to your neighbor but accidentally write it for the wrong amount. Writing a new check may solve the problem, but be careful with the old one.

The incorrect check may be deposited by someone else if you throw it away and someone else finds it. To ensure your bank account is safe from fraud, always write “VOID” across the check in big letters to ensure it’s never cashed.

What are the three steps to voiding a check?

You may know how to write a check, but making voided checks is different. If you want to void a check, ensure your bank account number and other personal banking information remain intact.

In addition, ensure that the check can’t be cashed. To protect yourself, here are the steps to properly void a check:

1. Write “VOID” across the front.

To start, take a blank check and print “VOID” in large letters across the center with a blue or black pen.

Today, many banks use technology to convert paper checks into electronic payments to process transactions faster. If you use a color other than blue or black, the machines that scan checks may miss the “VOID” label and process the check anyway.

When writing the word “VOID,” make the letters large and easy to read. You can also write “VOID” in smaller letters on key areas like the signature line, payee line, and amount line on the right, but it’s not mandatory.

Although you want to make the lettering as large as possible, avoid making any marks along the bottom if you need to give the check to someone to deposit or withdraw money electronically. The check won’t be usable to the other party if the words are so big that they cover the account details like routing and account numbers.

2. Add this note to your check register.

Once you’ve made your voided check, note it in your check register. Doing so allows you to keep track of what happened to that check.

Record all checks in your check register to ensure you don’t lose or misplace any of them. Lost checks can result in an unwanted debit from your account.

When your statements arrive for each current period, double-check your account information. While check voiding can prevent anyone from depositing or cashing the check, keeping an eye on your account is still a good idea.

3. Make a copy of your voided check.

Once you’ve written your void check, photocopy it to keep on hand. This way, if you need to provide any other voided checks, you can use the copy instead of wasting another check from your checkbook.

Keeping a photocopy of void checks can also protect you if somehow an old check you intended to void ever gets presented to a bank in the future.

Can you just write void on a check to void it?

Technically, all you need to void a check is to complete the first step above by writing void on the front. If you don’t do steps two and three, your voided check can still serve its purpose. However, you may run into difficulty in the future if you somehow misplace the check and someone tries to use it.

What if you don’t use checks but need a voided check?

Only some people order checks for their bank accounts. If you find yourself needing to present a voided check to an employer to have your paycheck direct deposited or to a company for setting up electronic payments, visit your bank.

Many banks offer checks for this purpose, but you may need to pay a fee for the service.

Let the representative know why you need the voided check. Otherwise, they might give you a starter check that doesn’t have your name printed at the top. Since the check won’t identify you, it may not be sufficient for presenting to someone for setting up direct deposits or payments.

What if I’m out of checks?

If you have run out of checks, you can either order more or go to your financial institution and have them provide you with one.

What happens when you void a check in QuickBooks?

When you void a check with Quickbooks accounting software, the amount of the transaction will appear as zeros, and the check will remain in your account information for future reference.

Is it better to void or delete a check from QuickBooks?

Whether you’re using Quickbooks online or with a program, it’s generally best to void a check rather than delete it. Voiding checks makes a record of the transaction for future reference.

If you delete a check, it will disappear from your history. If you ever need to find out what happened to a particular check number, you won’t be able to easily research the problem as a result.

What’s the difference between marking a check for mobile deposit and voiding it?

A mobile deposit refers to when you take a photograph of a check and send it to your bank rather than putting it in an ATM, taking it to a branch, or mailing it to your financial institution.

For a check to be eligible for mobile deposit by the recipient, the payer must write “For Mobile Deposit Only” at the bottom, directly under the signature on the front or back of the check. Making this indication ensures you can use the check for mobile deposits only.

Making a check only available for mobile deposits differs from a voided check. A voided check cannot be cashed in any way. Marking a check for a mobile deposit ensures the recipient can only deposit the funds by mobile banking.

Can you void a check after it’s been delivered?

If you’ve made an error on a check and the payee’s received it, you can no longer void the check. To ensure a check isn’t cashed by the recipient, call your financial institution and put a stop payment on the check.

You’ll need to provide the check number and the total amount written. If you don’t have all the information, you likely won’t be able to stop the payment from going through.

Typically, banks charge a fee for stop payments. You can request one up until the time the person you wrote the check to presents it. You typically can’t stop payment once they submit the check for cash or deposit it.

Conclusion

The information outlined above can help you easily void checks to set up payments, begin receiving direct deposits, or correct errors. If you still have questions, contact your financial institution.

Remitly is on a mission to make international money transfers faster, easier, more transparent, and more affordable. Since 2011, millions of people have used Remitly to send money with peace of mind. Visit the homepage, download our app, or check out our Help Center to get started.