Wherever you are, it’s good to be aware of the different forms of payment at your disposal. If you’ve left your home country, it’s especially important to know what payment options are available to you. If you’re new to the world of checks, here’s everything you need to know.

Prepaid debit cards and credit cards have become much more common and available over the last couple of decades, but checks are still in use. In fact, there are several different types of checks, and each of them serves a different purpose. In this post, we’ll explain the major types of checks, how to use them, and what the strengths and weaknesses are for each.

What Are the Different Types of Checks?

There are several kinds of checks, each having its uses, strengths, and weaknesses. The most common ones are the following:

- Traveler’s

- Certified

- Personal

- Cashier

- Money orders

- Electronic checks

- Wire transfers

Traveler’s Checks

What is a traveler’s check? A traveler’s check is a form of exchange that represents a certain amount of money. Often used by tourists, they’ve been popular because the bank that issues the checks secures them against loss or theft. In other words, if you were to withdraw $500 of traveler’s checks from your bank account, they would act like cash in the country to which you’re traveling. Unlike cash, however, if your traveler’s checks get lost or stolen, you will be able to recover the money from the bank.

Here’s the process for using traveler’s checks:

- When your bank issues your traveler’s checks, you usually need to sign the check in the presence of the banker.

- Sometimes the bank will charge a transaction fee, and sometimes it will be free.

- You can usually use them as cash to buy goods and services. Restaurants and hotels may very well accept them as cash.

- You can also cash them at a bank.

- You’ll usually need to countersign the check in front of the person receiving them to protect against counterfeit.

Traveler’s checks were especially popular beginning in the 1980s, but since the rise of prepaid debit cards and credit cards, they are not as in demand. They take up more room in your wallet or purse, and they can more easily fall out. However, they usually have no expiration date, so if you don’t use them all up in one trip, you can either return them to your home bank or use them the next time you travel.

Certified Checks

A certified check (or certified bank check) is a personal check that your bank has guaranteed to be valid and has designated the funds for the check. This kind of check is often required by a seller for a major purchase, like a house. If the seller wants to ensure that they will receive the money as represented on a check, they may want a certified check, since it is backed up by the bank. A certified check provides more security for the seller than does a personal check.

As the payer, you’ll go through this process to get and use a certified check:

- You will go to your bank and ask for a certified check, with small fees usually attached.

- You’ll provide your signature, to increase security for the recipient.

- If you then take the check to the seller (in this case, the seller of a house), the seller will receive the check and take it to their bank to cash.

- Like a traveler’s check, a certified check is treated as cash.

If you lose a certified check and want to get another from the bank, the bank will probably ask you for an indemnity bond. The indemnity bond will guarantee that the bank is not responsible for paying both the first (the lost one) and second checks.

Personal Checks

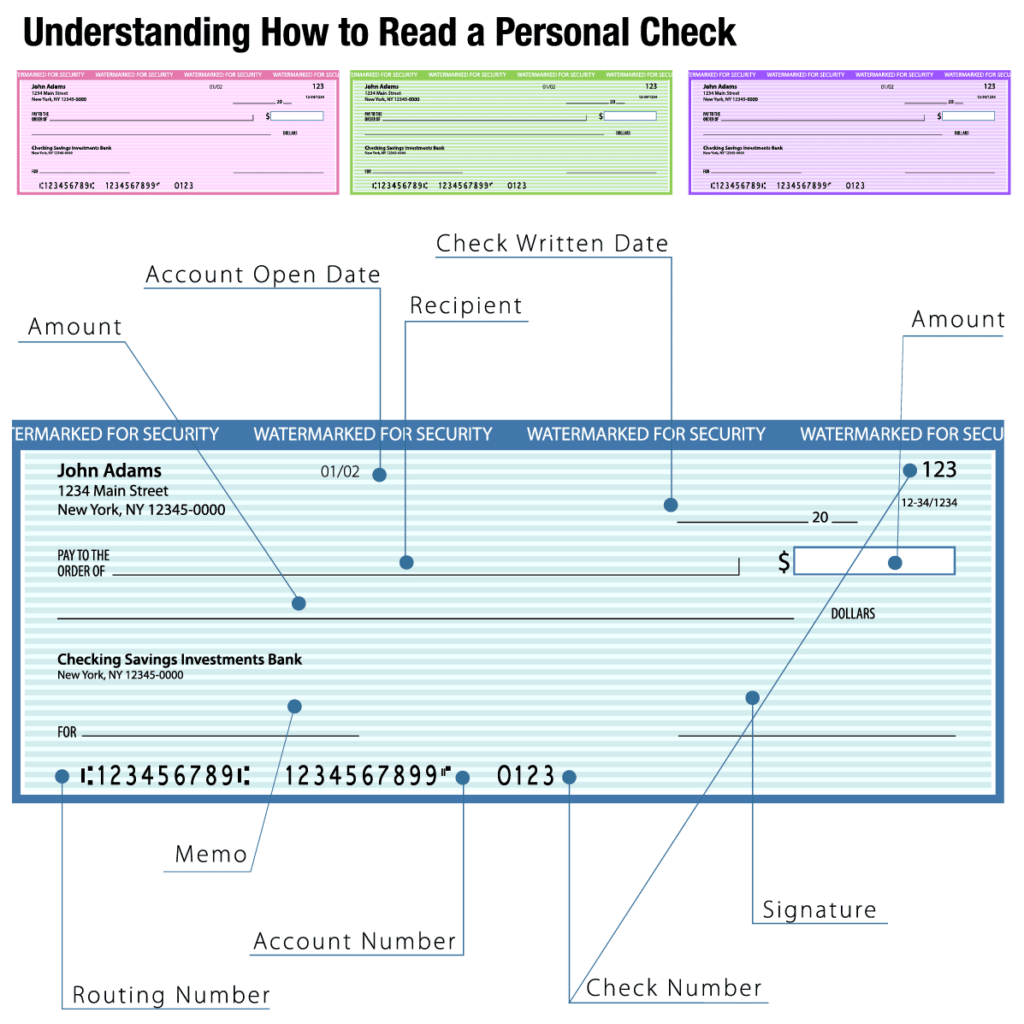

A personal check is the most common type of check and the easiest to acquire. A personal check will include the following:

- name of the recipient

- the amount of money you want to pay

- the name of the bank

- your signature

It is a promise that the recipient of the check will be able to cash or deposit the amount of money written on the check. When the recipient cashes or deposits the money, the amount of money on the check will be deducted from your checking account.

Unlike a certified check, the bank does not require you as a payer to have the required funds in your bank account for you to fill out and sign the check. This means that if you give a check to someone, they cash it, and your bank does not have the required amount, your check will “bounce.” This means the following:

- The recipient will usually have to return the funds if the check bounces.

- As the payer, you will likely be charged an overdraft fee and will be required to make up the difference.

- If you don’t do this, your account will likely be suspended or shut down.

Cashier’s Checks

A cashier’s check is a form of payment guaranteed by the bank. It will usually include the following:

- Unlike a certified check, which only requires the signature of the customer, a cashier’s check will always have a signature from at least one bank employee.

- A watermark

- The address of the bank

- The phone number of the bank

All of these are included to heighten the security of the check for both payer and recipient.

As with certified checks, a seller may require a cashier’s check for a major purchase.

Other Types of Checks May Be Right For You

While the above types of checks are the most common, there are a few others worth mentioning.

Money orders are paper forms of payment that can be purchased with cash, traveler’s checks, or debit cards. They are different from personal checks because their payment is guaranteed. They cannot bounce.

An electronic check is the same as a personal check, but it’s done completely on the internet. It has the same level of security, but it’s much easier to use than a personal check. It is a form of ACH processing.

Wire transfers are similar to electronic prepaid cashier’s checks. Either the funds go from one bank account to another, or you’ll use a wire transfer service like Remitly.

Remitly makes international money transfers faster, easier, more transparent, and more affordable. Our reliable and easy-to-use mobile app is trusted by over 5 million people around the world. Visit the homepage or download our app to learn more.