When you’re setting up financial accounts or services in the US, especially as an immigrant, you might be asked for something called a “voided check.” It sounds a bit strange—why would someone want a check you can’t even use? Understanding what a voided check is and why it’s requested can help you handle these common financial tasks with confidence.

At Remitly, we know that managing finances in a new country comes with learning new financial terms and processes. This guide will explain exactly what a voided check is, the common situations where you’ll need one, how to void a check properly and safely, and what alternatives you might be able to use if you don’t have checks.

What is a voided check?

Let’s start with the basics of what a voided check is and why it could matter to you.

Definition of a voided check

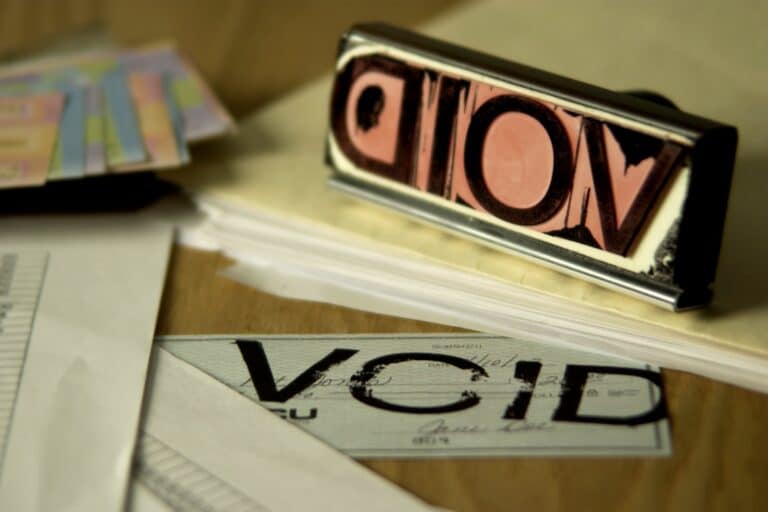

A voided check is simply a paper check from your checking account that has the word “VOID” written across the front in large letters. This clearly marks the check as unusable for payment—it can’t be filled out, cashed, or deposited.

However, even though it’s voided, the check still displays important information printed at the bottom, such as your bank’s routing number, your account number, and often your name and address, which are used for verification.

The significance of a voided check in personal finance

The main purpose of a voided check is to provide a safe and accurate way to share your banking information. When setting up electronic transactions like direct deposit or automatic bill payments, companies need your exact routing and account numbers to link to your bank account electronically.

A voided check serves as official proof of these numbers directly from your bank-issued check, reducing the risk of typos or errors that could occur if you just wrote the numbers down. It confirms the account exists and belongs to you.

When is a voided check needed?

There are a few common scenarios where you might be asked to provide a voided check.

Setting up direct deposit

This is perhaps the most frequent reason. When starting a new job, your employer will likely offer direct deposit so they can pay your salary directly into your bank account. Providing a voided check gives the payroll department the verified account and routing numbers needed to set this up correctly through the Automated Clearing House (ACH) network. Government benefits, like Social Security or tax refunds, may also require a voided check for direct deposit.

Initiating automatic payments

You might also need a voided check when setting up automatic electronic payments (often called ACH debits or direct debits) for recurring bills like rent, mortgage payments, utilities, loan payments, or insurance premiums. The company you’re paying uses the information to withdraw the funds from your account automatically on the scheduled dates.

Correcting payment errors

Less commonly, if there was an error in a previous electronic payment setup, maybe a mistyped account number, a company might request a voided check to ensure they have the correct banking details for the future.

Other uses

Voided checks can also verify account ownership for electronic transfers, like linking bank accounts or setting up investment accounts. They’re a trusted way to confirm your details without exposing active checks.

How to void a check

Voiding a check is simple, but you have to do it correctly to ensure it serves its purpose without creating security risks.

Step-by-step process for voiding a check

- Get a blank check: Take a check from your checkbook that you haven’t filled out.

- Use permanent ink: Grab a pen with blue or black ink, or a permanent marker. Avoid using a pencil or erasable ink.

- Write “VOID” across the check: Clearly write the word “VOID” in large capital letters across the front face of the check. Make it big enough to cover most of the check’s central area.

- Ensure numbers are visible: While writing “VOID” in large letters is important, be careful not to block out completely the routing number and account number printed along the bottom edge of the check. This information is usually the reason the voided check is needed in the first place.

- Do not sign: You don’t generally need to sign a voided check. Leave the signature line blank unless specifically instructed otherwise.

- Make a copy: Even if you’re sending the check electronically, keep a digital or physical copy for your records.

Tips for ensuring accuracy and security

Keeping a copy of the check and using permanent ink are both about security. And there are a few more things you can do to make sure you’re not exposing yourself to fraud.

- Record the check number: Make a note of the check number you voided in your check register or personal records. Write down the date and why you voided it (for example, “Voided for employer direct deposit setup.”) This helps you account for all your checks in sequence.

- Protect the information: Even though the check is voided, it still contains sensitive banking details. Handle it securely and don’t leave it lying around.

- Secure disposal: If you void a check in error and it turns out you don’t need to submit it, destroy it properly. Shredding is best, but tearing it into small pieces, especially across the account and routing numbers, is also effective. Don’t just toss the whole check into the trash.

- Secure transmission: If you’re emailing the voided check, use encrypted files or password-protected links, not plain attachments.

- Submit securely: When you give the voided check to an employer or company, hand it over in person if at all possible. If not, use a secure submission method recommended by them.

Alternatives to a voided check

What if you don’t have paper checks, which is increasingly common with the rise in online banking? Fortunately, there are usually alternatives.

Other documents to provide banking information

Many employers and companies now accept other forms of bank account verification instead of a physical voided check.

Direct deposit authorization form

Your employer or the company might provide their own form where you fill in your routing number, account number, account type (checking/savings), and bank name. Sometimes this form needs to be signed.

Bank-provided direct deposit form

Many banks offer a pre-filled direct deposit form through their online banking portal that you can download. This official document includes all the necessary account details.

Bank verification letter

You can ask your bank (often via online banking or visiting a branch) for an official letter on bank letterhead that confirms your account details, including routing and account numbers, account type, and often the date the account was opened. This is sometimes called an account verification letter.

Counter check

If you visit a bank branch, a teller might be able to print a single “counter check” or “starter check” which contains your account information. You can then void this specific check. Some banks might charge a small fee for this.

Deposit slip

In some cases, a pre-printed deposit slip might be accepted, as it also contains your account number and sometimes the routing number. However, this is less common, as not all deposit slips have the routing number.

When alternatives are acceptable

Acceptance varies. Employers might take a direct deposit form, while billers may insist on a voided check. Government agencies often have strict rules, so verify the requirements for your own circumstances. Contact the organization’s HR or customer service to confirm what they’ll accept to avoid delays.

Follow everything in this guide and you shouldn’t have any problems voiding checks.

Frequently asked questions

Why would you need a voided check?

The primary reason is to provide your bank account number and routing number securely when you’re setting up electronic transactions like direct deposit from your employer or automatic bill payments. It acts as verification of your account details. You might also need one if you made a mistake writing a check and want to ensure it can’t be used, while keeping it for your records.

What can be substituted for a voided check?

Common substitutes include an official direct deposit form from your bank or employer, a bank verification letter confirming your account details, or sometimes a counter check obtained from your bank branch that you then void. Check with the requesting party about acceptable alternatives if you don’t have a checkbook.

Is a voided check bad?

No, having or providing a voided check is not a bad thing. It’s standard practice for verifying banking information. Voiding a check simply makes it unusable for payment while keeping the account information visible for setting up electronic links. It’s actually a security measure when it’s done right.

Can you get a single voided check from the bank?

Yes, usually. If you don’t have a checkbook, you can visit your bank branch and ask for a “counter check” or “starter check.” The teller can print one for you with your account information, and you can then write “VOID” on it. Alternatively, ask for a bank verification letter or direct deposit form, which serves the same purpose.