You’ll notice a series of numbers at the bottom of your personal checks. Each set of numbers represents important information. Read this Remitly guide to find out how check numbers work and when you may need them.

How Do Check Numbers Work?: A Visual Guide

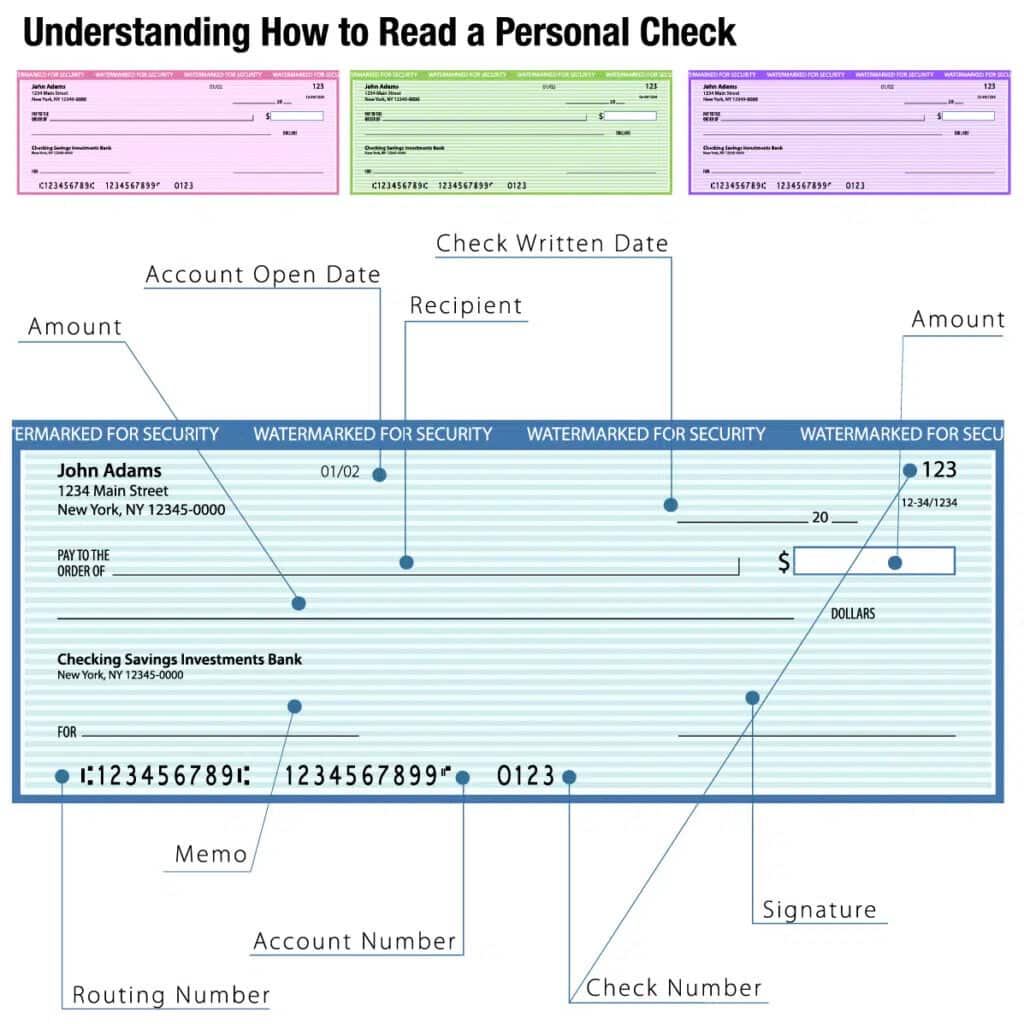

No matter the color or design of your personal check, it will share certain features. So, even if your check doesn’t match those shown in the image below, the information still applies.

Meaning of Check Numbers

There are three sets of unique numbers at the bottom of each check. Here’s a closer look at the meaning of each:

| Number | Description |

|---|---|

| Routing Number | Represents your bank’s routing number, also known as the transit number. |

| Account Number | Represents your personal bank account number. |

| Check Number | Unique identification number. It appears on the bottom alongside the routing and account numbers and in the top-right corner. |

| Fractional Bank Number | Appears at the top of the check, separated by a forward slash (/), and represents the bank from which the check originates. |

Routing Number

The first set of numbers on the bottom of your check represents your bank’s routing number, also known as the transit number.

This is your bank’s nine-digit bank identification number, representing the financial institution that holds your account, not the account itself. Anyone with an account at the same bank branch will have this routing number on their checks.

This number allows a bank to send and receive money from other financial institutions. Think of it as an address. Some banks have multiple routing numbers, while others have just one.

There are many scenarios in which you’ll need your routing number. Some of the most common include but are not limited to:

- Processing a check

- Setting up recurring online bill payments (i.e., cell phone payments and online subscriptions)

- Setting up direct deposit with your employer

- Sending and/or receiving wire transfers

Account Number

The second, or middle, set of numbers on the bottom of your check represents your personal bank account number. When you write a check and the receiving party deposits it into their bank account, the funds will be pulled from this account.

This number is unique to your account and your account only, so it’s crucial to keep it safe to avoid fraudulent bank activity.

Check Number

How do check numbers work? It’s all about their location.

Each check has its own unique identification number, which appears on the bottom alongside the routing and account numbers. The same number also appears in the top right corner.

When you open a new checking account, the first check in your book will typically start with 0001 and increase by one digit with each check following (i.e., 0002, 0003, etc.).

When you finish your checkbook and order another, it’s a good idea to start with the number where the previous checkbook left off.

The purpose of the check number is to identify the individual check used.

For example, suppose you misplace a check and need to put a stop payment on it. In that case, you can notify your financial institution using the specific check number associated with the payment you need to cancel.

The check number helps the bank identify your checks, too. If you ever need to issue a stop payment on a check, you’ll need to provide the number of the check.

Fractional bank number

The fractional bank number is a series of digits that appear at the top of the check. It looks like a complex fraction with two numbers stacked on top of one another and separated by a forward slash (/).

Although it looks complicated, the fractional bank number is another way of representing the bank from which the check originates.

At one time, financial institutions relied on fractional bank numbers to track where to withdraw and deposit money when they went through the process of crediting and debiting checks.

Even though the banking system has advanced to largely eliminate the need for fractional bank numbers, banks continue to print them on checks.

What Happens to Check Numbers If I Get a New Bank Account?

If you change your bank account, you’ll need to get new checks associated with your new account number. It’s important to shred or void all remaining checks with the old bank account number.

You’ll also need to add your new banking details, like subscriptions and credit cards, to your recurring bill accounts. You’ll find the relevant account and routing information right on your new checks.

Remember that your credit and debit card numbers are not the same as your routing and account numbers.

When you open a checking account at some banks, you’ll receive a small complimentary book of starter checks.

Like other types of checks, starter checks display the account number, routing number, and fractional bank number. However, they won’t have your name and address printed on them.

In some cases, starter checks don’t display check numbers either.

Because the lack of an identifying check number can make it harder to keep track of checks written, you’ll likely want to discontinue using the starter checkbook as soon as your first personal check order arrives.

Be sure to shred unused starter checks to protect your account information.

What If I Have a Joint Bank Account?

If you have a joint bank account with your spouse or another person, both of your names will appear on the checks, granting you both the authority to pay with them. One account holder can write checks without the approval of the other account holder.

If you don’t want your transactions or check-writing access to be shared, consider opening a new personal checking account. Or, you may choose to open a savings account jointly but keep your checking account(s) separate.

Can I Verify My Check Numbers Online?

If you don’t have access to your checkbook, you can still verify your routing number and account number by signing in to your bank account online.

The location of these identification numbers varies by financial institution. You can usually locate them by either searching “routing number” or “account number” in the search engine or by expanding your account details.

You can also verify these same numbers on your bank statements, whether paper or electronic.

If you can’t find your statements and have difficulty accessing the website, you can request information about which check numbers have cleared in other ways.

Stop into a branch and talk to a customer service representative, or contact your bank via phone or online chat.

How do I choose the starting check number when I order checks?

When you complete a check order form, you’ll typically be asked to provide a starting check number.

To keep your checks in sequential order, look at the last set of checks in the box you currently have. Turn to the last check and then write the check number that comes next on the form.

Keep in mind that it is possible to use a completely different number when you reorder checks. For example, say the last check number was 2005. If you wished to, you could jump ahead to 4000 or 5000.

Some people choose to advance their check numbers in this way each year. With this approach, checks in the 4000s might be for 2024, and the 5000s might be for 2025.

How you choose the numbers when ordering checks for your checking account is up to you, so feel free to number them in a manner that will be easy for you to track.

Check number FAQs

If you still have questions about check numbers and how they affect your checking account, read on for answers.

Will companies and stores accept low-number checks?

In some cases, a store or company may be unwilling to accept a personal check with a low number due to concerns about fraud.

Low numbers may indicate that an account is brand new, and the party you’re attempting to pay may fear the check will bounce when they attempt to cash or deposit it.

You’re more likely to encounter this problem when you’re writing a check for a large amount.

Does an electronic check have a check number?

If you use an online bill pay service, your bank will likely send payments as electronic Automated Clearing House (ACH) transactions whenever possible. In this case, the payment will be withdrawn from your checking, and you won’t see a check number.

When an ACH payment isn’t possible, the service may draw up a paper check from your checking account and then send it to the payee. A check number will appear on the paper check, and it usually won’t follow the current sequence of numbers in your current checking book.

Does a direct deposit have a check number?

A direct deposit is usually processed through the ACH system. As a result, you normally won’t see a check number associated with direct deposits into your checking account.