Do you need to send money to a friend or to transfer money between bank accounts? Routing and account numbers will likely come into play.

In the United States, every bank account comes with two codes to make banking transactions: the routing number and the account number.

A routing number identifies a specific bank during a transaction, while an account number uniquely identifies your personal account within that bank.

Learn more with this guide from our team at Remitly.

What is an account number?

An account number is a unique identifier for each bank account. It’s similar to a phone number—no one else at your bank has the same one.

Every bank has its system for assigning account numbers. Some banks assign a seemingly random number to each customer account. Other banks might use a customer number with a hyphen for each account.

For example, a customer might have account 12345-1 for their checking bank account and 12345-2 for their savings account.

Account numbers are necessary for banking transactions because they identify the account involved. Since each bank potentially has millions of customers and account numbers, you must specify an account number to complete a transaction successfully.

What is a routing number?

A routing number is a nine-digit code that identifies the bank involved in the transaction. Routing numbers are officially called ABA routing numbers. The American Bankers Association created routing numbers in 1910 to make check processing more secure.

Today, the ABA still manages routing number information for all banks in the United States.

Every bank has its own unique routing number. In a financial transaction, the bank will receive the funds through the routing number, look up the customer’s account number, and deposit money into the correct account.

However, some banks have more than one routing number. This happens with big banks or when banks merge with another bank. Some banks might also have different routing numbers for wire transfers and ACH transfers.

If you know your recipient’s routing number, you can determine which bank the transaction will go through. But without the account number, it’s impossible to specify which account the transaction is for, so you need both numbers to send or receive money.

What is an International Bank Account Number?

Given its name, you might think that an International Bank Account Number (IBAN) is a name for a recipient’s account number at an international bank, but that isn’t the case. An IBAN is a number that banks use when processing international transactions like international wires. It consists of:

- A two-digit country code

- Check digits assigned by the initiating financial institutions

- A unique bank identifier code that identifies the financial institution

- A BBAN that identifies a specific bank account at the receiving bank

Learn more about IBANs by checking out our article on the subject.

Where can you find your account number and routing number?

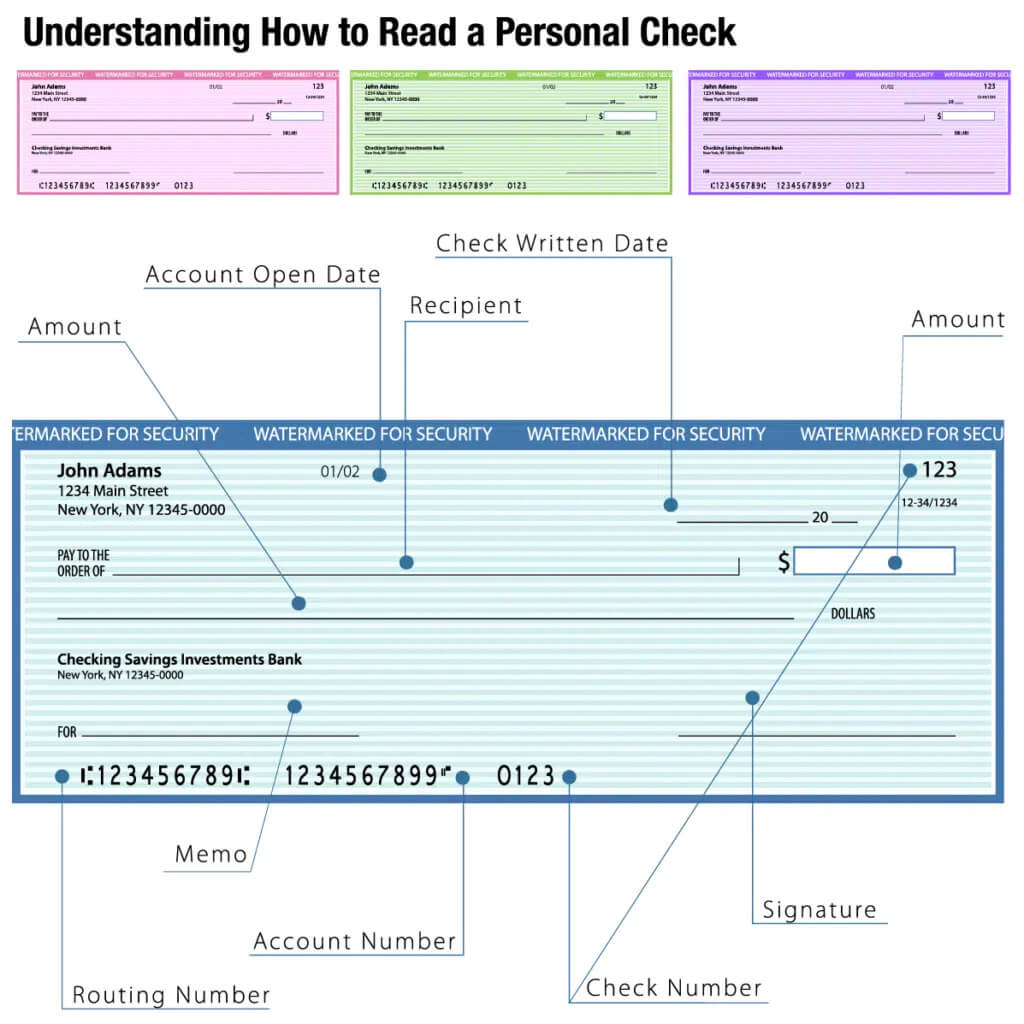

You can find both your account number and bank routing number in your checkbook at the bottom of your checks. Be sure not to confuse them with the check number.

The numbers at the bottom of a check, from left to right, are:

- Routing number

- Account number

- Check number

The check number is usually also at the top of the check, so if you aren’t sure where the account number ends, you can:

- Look to the top of the check to determine the check number.

- See which numbers change. Each check has an individual check number, so you can look at two checks to see which number changes (the check number) and which ones stay the same (the routing and account number).

You can find your account and routing numbers in your online banking portal. Each bank puts them in different places in your mobile banking app or online account. If you need help finding these bank account details, simply search online or contact your bank’s customer service.

If you only have an account holder’s bank account number, you may be able to use the American Bankers Association’s bank routing number finder to get the ABA number. You can search by bank name here.

How are routing and account numbers used?

Originally, the ABA created routing and checking account numbers to process paper checks more easily. Thanks to routing and account numbers, banks can quickly determine which bank each check goes to and which customer it applies to.

But aside from paper checks, you can also use routing and account numbers for:

- Transferring funds between banks through a wire transfer, cash app, or money transfer service

- Making automatic bill payments

- Automated clearing house (ACH) transfers

- Enrolling in payroll services with your employer, such as direct deposit

- Ordering new checks

Even when you use your routing number and account number digitally, the transactions still go through because the numbers effectively replace a paper check.

In fact, many banks save time by converting checks into electronic payments instead of processing them by hand.

How many digits are in a routing number vs. an account number?

Since the ABA governs routing numbers, they’re always nine digits long. This is helpful because it standardizes routing numbers across the U.S. banking industry.

As for account numbers, there is no standard format. Each bank or credit union chooses its own format, but the number needs to be long enough for each account to have a unique number. Generally, bank account numbers at most U.S. financial institutions are eight to 17 digits long.

Do debit and credit cards have routing numbers?

A credit or debit card does not have a routing number like a checking or savings account. They do have an account number, but it’s in a different format than a standard account number for a bank account.

Most major banks issue debit cards through the Visa or MasterCard networks using 16-digit account numbers. Discover Card and American Express also use 16-digit numbers.

A credit card account number works similarly to the numbers on the bottom of your checks. The first part of a credit card number identifies the bank, and the second part identifies the customer.

Do you need a routing or account number to use an ATM?

ATMs identify you by your debit card number. You don’t need to use a routing or account number at an ATM.

If an ATM asks for this information, call your bank to confirm before sharing your account number or routing number..

Is it safe to give out your routing transit number or account number?

Always guard your account information and keep it secure. If the wrong person has your routing and account number, they may be able to withdraw money from your account without your knowledge.

However, providing your full account number and routing number to pay bills online is generally safe because the same information is on your paper checks.

If someone fraudulently withdraws money from your account, your financial institution has a legal obligation to reimburse you for unauthorized transactions. The reimbursement process depends on whether it is a member FDIC bank or a credit union that falls under other agencies.

Some people prefer to use their bank’s online bill pay instead of giving out their account information. This can also make it easier to change your bill payments if you change banks. Sometimes, it’s cheaper than mailing personal checks, too.

Can you transfer money using account and routing numbers?

You can only do some money transfers with your account and routing numbers. The ACH network that allows these transfers is a system for American banks only. International transfers usually require another transfer method.

In addition, consumer bank accounts often limit you to only adding transfer accounts that are in your own name. You usually need to use another service to transfer money to other people.

You can give businesses your account number and routing number because they use commercial payment processors that don’t handle transactions between consumers to move money from one bank to another.

If you need to send money internationally, Remitly is a good alternative to ACH transfers. Remitly is a digital money transfer service that enables customers to make person-to-person international money transfers with unparalleled peace of mind.

With Remitly, you can send money to your recipient’s bank account from your personal account or transfer funds using your debit card or credit card. Choose your card as the funding source, and you may even be able to send money instantly or within one business day.

Routing number vs. account number: Both are essential for U.S. transfers

When it comes to routing numbers vs. account numbers, routing numbers identify the recipient’s bank, and account numbers specify an individual’s U.S. bank account. If you’re transferring money in the United States, you’ll likely need both numbers for the transaction to go through.

However, transferring money with routing and account numbers isn’t an option if you want to send money to your loved ones in another country.

Simplify how you send money to your loved ones with a convenient money transfer app that charges low fees for electronic transfers like Remitly.