Post Summary

3 Tax Tips for U.S. Immigrants:

- Determine if you’re a resident or nonresident alien.

- Get an ITIN or SSN.

- Understand your rights.

If you work in the U.S., you are required to pay taxes. This is true for all immigrants, whether the United States categorizes you as a resident or nonresident alien. All are obligated by law to pay income and payroll taxes for each year of work in the U.S.

However, there are differences in how you file taxes. It all depends on your residency status. This guide created by our team here at Remitly will help you understand how immigrants in the United States are taxed, why it’s required, and how to get help with the process.

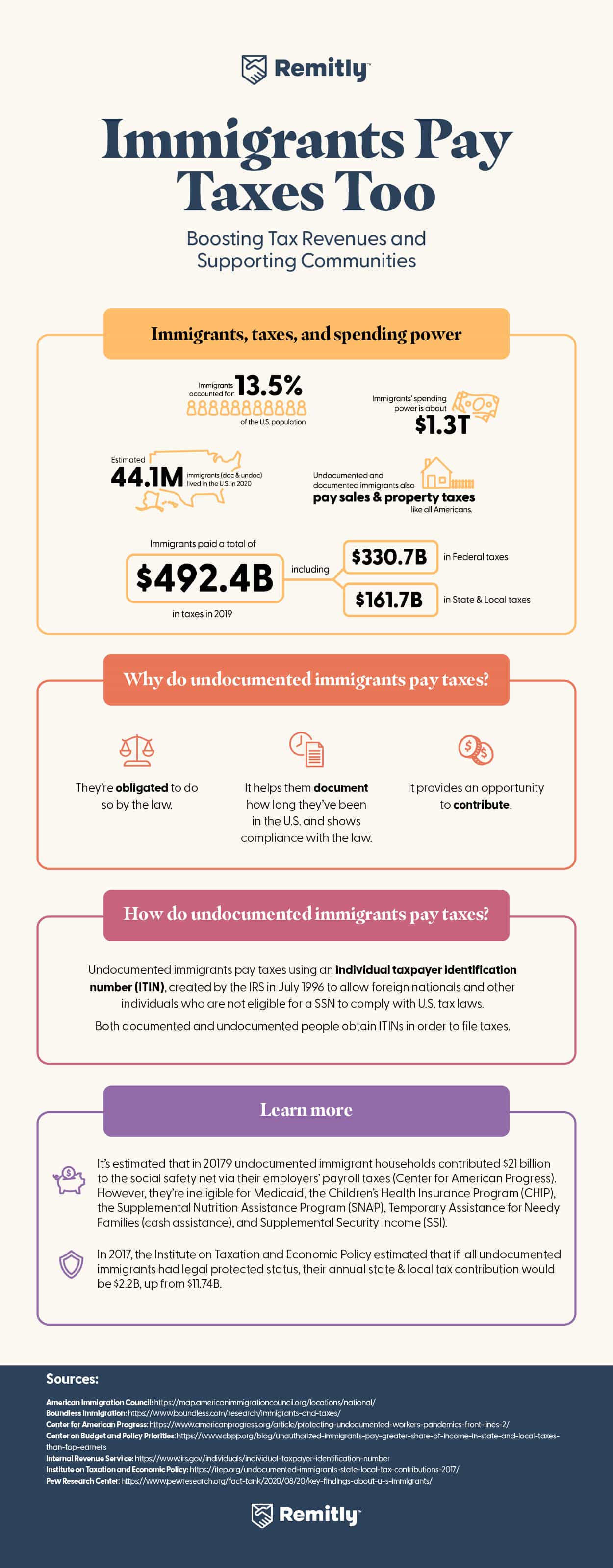

Before we get started, let’s take a moment to appreciate the contributions of immigrants. Did you know they pay billions of dollars in taxes to the U.S. government each year?

In fact, as the American Immigration Council reports, undocumented immigrants alone contribute huge sums via income and payroll taxes.

How U.S. immigrants are taxed

The United States tax laws refer to immigrants, foreign workers, and undocumented immigrants as resident and nonresident aliens. Generally, resident aliens are taxed the same way as U.S. citizens. Non-residents, on the other hand, are taxed based on special rules in parts of the Internal Revenue Code (IRC).

If you’re unsure whether you’re considered a resident or nonresident alien for U.S. income tax purposes, check the IRS’ Determining Alien Tax Status page. There, you can determine whether you pass the “substantial presence” test.

For instance, green card holders are considered resident aliens. To be responsible for filing taxes, they need to pass the green card test by being physically present in the U.S. for a minimum of 31 days during the current tax year and at least 183 days within the last three years (including the current calendar year). Their residency date starts the first day they’re physically present in the U.S. after receiving lawful permanent residency status.

Nonresident aliens are those who aren’t permanent residents. For instance, if you have a work permit or you’re an undocumented immigrant (having entered the U.S. without authorization or with an expired legal status). You won’t need to pass a physical presence test, but you will still need to make tax payments.

Identification Numbers for Filing Taxes

Individuals who file taxes will need to obtain either a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). These numbers will identify you as a taxpayer in the U.S., and which number you’ll use will depend on your residency status.

What is a Social Security Number?

Resident aliens usually qualify to receive Social Security Numbers issued by the Social Security Administration (SSA). This number is used to track an individual’s lifetime earnings and provides access to federal, state, and local benefits, such as the child tax credit or the American Opportunity tax credit for higher education expenses.

Social security numbers are nine digits long and have a format that looks like XXX-XX-XXXX. Typically, parents apply for babies’ social security numbers when filling out their birth certificates.

Non-citizens considered resident aliens can apply for a social security number online at the SSA website. You’ll typically need to provide documentation that proves your identity and residency status.

Once your application is approved, you’ll be sent a social security card with the number printed on it. Keep this number secret and store the card in a safe place. A social security number is valid for life and never needs to be renewed.

What is an Individual Taxpayer Identification Number (ITIN)?

Nonresident aliens can’t obtain a social security number. Instead, they will need to apply for an ITIN to file their taxes.

This number is for the sole purpose of offering you a method of paying taxes if you can’t qualify for an SSN. Anyone can be issued an ITIN, even spouses and other dependents of nonresident aliens.

For an ITIN, you’ll apply through the IRS using form W-7. You can learn more about it on the IRS website.

Generally, you’ll need to renew or revalidate your ITIN every five years. If you haven’t used your ITIN for filing taxes for three consecutive tax years, the IRS considers the number expired. If you need to use the number again, you must reapply.

ITIN processing time 2024

According to the IRS official website, you should receive your ITIN within seven weeks if all the information you enter on the application is correct and complete.

However, your wait time may be longer during the peak months from January to March. To ensure you can file a tax return by the due date, apply for an ITIN as soon as you can.

During the wait time, checking your application status intermittently is ideal. If you haven’t heard back from the IRS for over six weeks, contact them via phone.

Why do immigrants pay taxes?

Resident aliens receive the same federal, state, and local benefits as United States citizens, such as:

- Pell Grants and student loans

- Refundable tax credits

- Unemployment insurance

- Supplemental Security Income (SSI)

- Social Security benefits

- Medicaid and/or Medicare

- Children’s Health Insurance Program (CHIP)

- Supplemental Nutrition Assistance Program (SNAP)

Taxes help to fund these benefits, so as a non-citizen taxpayer, you’ll be eligible to receive them.

How do immigrants pay taxes?

There are many ways to file taxes as a U.S. resident or nonresident alien.

To start, you’ll need to collect all relevant documents so that you can provide accurate information. This includes your SSN or ITIN and forms showing your income, such as a 1099 and W-2.

As for where to file your taxes, you can do it yourself. There are plenty of online services from major companies. These programs will help you calculate what you may owe or get refunded based on your provided information.

Does an undocumented alien/non-resident alien pay taxes?

As previously mentioned, undocumented immigrants pay taxes in the U.S. Now, let’s dive deeper into the topic.

Who is an undocumented worker?

An undocumented worker is someone who isn’t a U.S. citizen or a legal permanent resident of the U.S. They generally don’t have valid visas or residency documents issued by Citizenship and Immigration Services.

Undocumented workers can include childhood arrivals whose parents brought them to the U.S. when they were young. The category also applies to people who entered the U.S. without going through an authorized checkpoint and to those who came to the U.S. with a valid visa but stayed after the document expired.

Why would an undocumented immigrant pay taxes?

Nonresident aliens, unfortunately, don’t have access to the benefits that other immigrants do, such as emergency services through Medicaid. Taxpayers with an ITIN are generally ineligible for most tax credits as well.

Given the lack of perceived benefits from paying taxes, why would a nonresident alien pay them?

For one, many undocumented workers participate in tax filing, hoping it might help them gain legal status and become citizens in the future, according to the Bipartisan Policy Center.

Filing tax returns is a way to indicate when someone entered the U.S. and the time they’ve contributed to the tax system. It may help prove the case that a person is of good moral character.

Tax forms can also verify that the children of undocumented workers were present in the U.S. because they list their names under dependents.

Another reason why many undocumented immigrants pay taxes is due to tax withholding. If they earn income through a job, their employer may withhold taxes from their wages. In this case, undocumented workers pay taxes with each paycheck and will need to file tax returns.

Will the IRS give out information about immigration status?

It’s natural for the undocumented to feel nervous about taxes. However, the Individual Taxpayer Identification Number is issued for federal tax reporting alone.

The IRS is barred from disclosing taxpayer information even to other federal agencies like the Department of Homeland Security (DHS) or Immigration and Customs Enforcement (ICE). That said, the Treasury Department or the IRS may be required to do so if your information is subpoenaed as part of a criminal investigation by federal courts due to an immigration law case.

What if I need help filing my taxes?

If you feel intimidated, you can head to an in-person tax preparation clinic or speak with an accountant who can file taxes on your behalf.

If you need translation or find these tax services too expensive, you can get help. Take advantage of the IRS’s Volunteer Income Tax Assistance (VITA) program. Volunteers are certified by the IRS to provide individuals with free basic income tax preparation services.

If you’re interested, head to the IRS website to locate a VITA site. You can also look at IRS Publication 3676-B (also available in Spanish) to verify which services are provided.

Before going, make sure you have all the required information and documents so volunteers can help you apply for an ITIN (if you need one) and prepare your tax return.

Answers to common tax questions from immigrants

If you have questions about how to file a tax return or whether you need to, read on for answers.

Why do immigrants file taxes?

In the U.S., tax laws are based on employment status and income level rather than immigration status. Immigrants can receive access to some government services that are available to all residents and are paid for through money collected as taxes.

Paying taxes can have personal benefits, too. Under U.S. immigration law, failure to pay taxes owed could prevent a lawful permanent resident from obtaining United States citizenship, even if they’re otherwise qualified.

Do I need to file if I have a side hustle?

Money earned through side hustles generally falls under the category of self-employment income, which is taxable. You generally need to claim the money on a tax return, even if you receive payment in cash from your customers or clients.

Does everyone in the U.S. file taxes?

Most people in the U.S. do need to file tax returns. While people who earn less than a certain amount normally don’t have to pay income taxes, filing can make it possible to receive refunds, earn credits toward Social Security, and access federal financial aid programs. A resident can also receive some of these benefits if they submit a tax return.

Can an immigrant file for themselves?

Yes, immigrants can prepare their own tax returns if they wish. You can use Free Tax USA to file your taxes directly to the IRS for free. The website also makes it possible to file state returns for a small fee.

If I have taxes withheld, do I need to file?

Tax withholding doesn’t exempt you from filing.

Your employer will give you a document called a Form W-2 at the end of the tax year. It lists the amount withheld and submitted to the government on your behalf. You’ll use this information to determine if the right amount was withheld.

Do I claim my worldwide income or just the money I earned in the U.S.?

Generally, you are responsible for paying income tax on all money that you receive, even if you earned it overseas while living in the U.S. In some cases, you may qualify for tax credits that reduce the amount you pay on income earned from sources abroad.

Where can I find information about the latest federal tax laws?

Rules and regulations regarding federal taxes, such as filing requirements and taxation brackets, can change from year to year. The IRS website is the go-to source for information related to taxes.

Do I need to pay state taxes?

In many states, anyone who must pay federal taxes annually may also need to pay state taxes. However, each state has its own laws related to taxation, and some states don’t have a personal income tax. Consult your state’s tax department for more information regarding your tax situation.

What types of filing options are there for federal tax returns?

There are five filing options:

- Individual: An individual income tax return is for an unmarried person.

- Married, filing jointly: This type of tax return is for married couples who want to file together.

- Married, filing separately: With this type of tax return, married people each file their own tax return.

- Head of household: This tax filing status is for people who are unmarried but responsible for financially supporting a qualified person, like a child.

- Qualifying widower with dependent child: A person whose spouse has passed away and has one or more dependent children can opt for this filing status.

If you’re not sure which option is right for you, seek the advice of a knowledgeable tax professional.

Learn More About Your Taxes

- A Step-by-Step Guide to Filing Taxes in the U.S. for the First Time

- Where to File Taxes in 2024: A Guide for New U.S. Residents

- Do Immigrants Pay Taxes on U.S. Businesses?

- How to File Income Taxes in California with an ITIN

- How to File Pennsylvania Income Taxes with an ITIN

- How to File Taxes in North Carolina with an ITIN

- Oregon Tax Filling for ITIN Holders: A Step-by-Step Process

- How to File New York Taxes with an ITIN

- Illinois Income Tax for Non-Citizens: Understanding ITIN Filing

- How to File a New Jersey Tax Return with an ITIN

Get ready for tax time

Whether you’re a green card holder, have temporary protected status, or fall under the category of undocumented or those on temporary work visas, the Internal Revenue Service will likely expect you to file taxes if you have income from self-employment or income earned from a job. You’re also likely to need to pay state and local taxes.

The abovementioned tax information should serve as a starting point for filing taxes. Now, seek assistance from a tax professional to learn what steps you need to take to file taxes correctly and settle any taxes owed so that you can comply with tax and immigration laws.