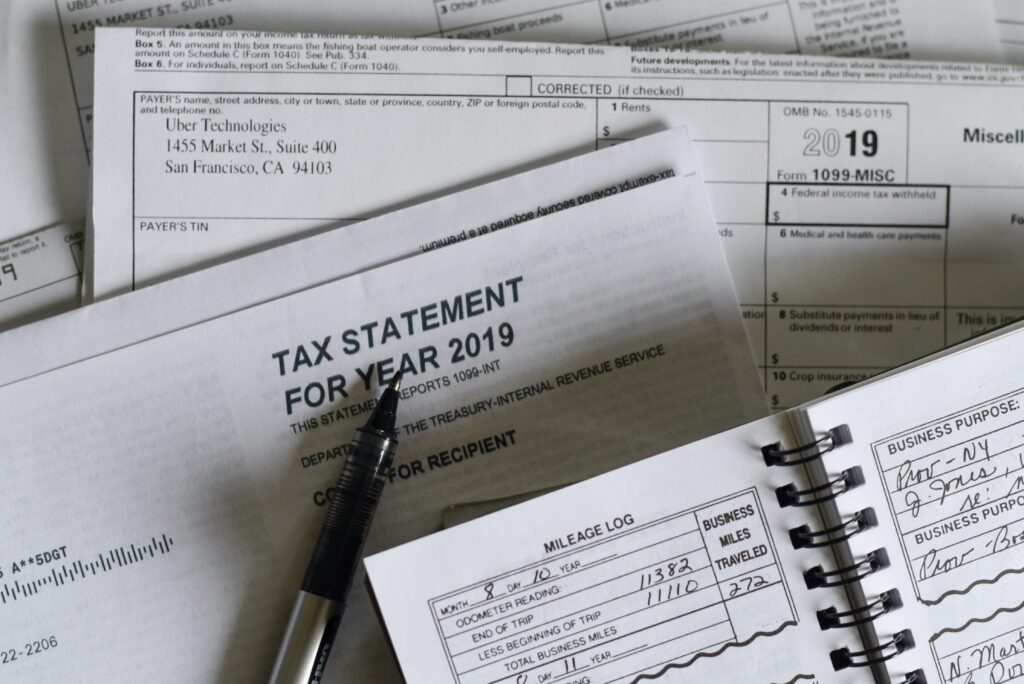

Filing your taxes and paying them by the deadline will protect the time and money you’ve invested in your immigrant-owned small business. It’s important to understand your tax responsibilities as a business owner so you don’t encounter any penalties or interest charges that can be costly.

You may have also encountered misinformation spread online that claims immigrants don’t pay taxes or that they receive special tax forgiveness; however, this isn’t true. How you’re personally taxed as an immigrant entrepreneur depends on the structure of your company.

To understand more about paying taxes for your specific business type, read the following tips or find a Certified Public Accountant who can help you submit the paperwork and payments.

To learn more about whether you should pay taxes as an immigrant without a business, visit our guide Immigrants Pay Taxes Too: Here’s What You Need to Know.

Federal business taxes

Immigrant-owned businesses are subject to the same federal taxes as other businesses in the U.S.

Your business may need to pay a number of federal taxes including:

- Income tax: this is based on the profits made by your company. The tax is passed through to the personal tax returns of sole proprietors, partners in LPs and LLPs, and members of LLCs.

- Self-employment tax: this covers Medicare and Social Security. Sole proprietors, partners, and LLC members usually pay self-employment tax.

- Payroll taxes: you’ll need to pay the following taxes if your business has employees

- FICA or Social security and Medicare taxes: these are paid annually by you in combination with the amounts withheld from your employees’ paychecks

- Federal income taxes: businesses are responsible for withholding federal income taxes from employees and submitting the money to the federal government at the end of the year

- Federal unemployment (FUTA) tax: you will need to pay this tax to help fund the federal unemployment system

Excise Taxes

Depending on your line of business, you may need to pay additional taxes called excise taxes.

Some of these taxes include:

- Environmental taxes

- Communications and air transportation taxes

- Fuel taxes

- Tax on the first retail sale of heavy trucks, trailers, and tractors

- Manufacturer’s taxes on the sale or use of certain goods or materials

- Wagering taxes if your business accepts bets or conducts lotteries

State, city, and local business taxes

In addition to federal taxes, immigrant-owned businesses are typically responsible for paying state taxes. Your business is also likely to be subject to city and/or local taxes too.

Rules and regulations for state, city, and local taxes vary widely from area to area. You can contact the U.S. Department of Treasury’s Bureau of Small Business Specialists about specific rules in your area or check out one of our guides to business ownership in the specific areas below for more information:

- Immigrant’s Guide to Starting a Business in Texas

- Immigrant’s Guide to Starting a Business in Florida

- Immigrant’s Guide to Starting a Business in New York

- Immigrant’s Guide to Starting a Business in North Carolina

- Immigrant’s Guide to Starting a Business in Ontario

Property taxes

If your business owns undeveloped land or a building, you’ll likely need to pay business property taxes. Tax rates vary from location to location. The amount that you pay depends on the assessed value of your property. Your local tax authority determines this amount and then tells you each year how much you need to pay.

Some areas also require businesses to pay business personal property taxes on things like:

- Office furniture

- Racks, shelving, and fixtures in retail stores

- Equipment like computers, copy machines, and cash registers

- Business supplies

Your local tax authority can give you specific information about whether you must pay business personal property tax and which items are taxable.

Sales and use tax

Some states also require businesses to pay sales tax and use tax.

- Sales tax: this is for products that you buy, use, rent, or lease

- Your business will pay sales tax when purchasing taxable items at the time that you complete the transaction.

- If you sell taxable items, you will need to collect sales tax from your customers and submit payments to your state department of revenue.

- Use tax: this is paid on items that your company purchases from other states that don’t charge sales tax (but are still taxable in your state).

- For example, if you buy something in another state and then use or store it in your state, you may need to pay use tax.

- Sellers and service providers don’t collect use tax. Instead, the buyer is responsible for reporting and paying use tax. This means you won’t have to worry about collecting use tax from your customers.

Sales and use tax laws vary greatly by state. You can consult your state’s department of revenue website for more information.

A few more tips about immigrant business taxes

Many immigrant entrepreneurs have questions about various tax situations. The following are some of the most commonly asked questions regarding taxes for immigrant-owned businesses.

Do I need to pay estimated tax payments?

Sole proprietors and partners typically need to pay estimated federal tax payments each quarter if they expect to owe at least $1,000 when they file their income taxes. If you’re required to make estimated payments and you don’t, you may face penalties when you file your annual income taxes.

Your state may also require estimated tax payments. An accountant can help you determine if you need to pay estimated taxes.

Do I need to apply for a Social Security Number or ITIN to pay taxes?

Yes, you will need to have some type of tax identification (ID) number to file and pay taxes. Without a federal tax ID number, you won’t be able to pay the taxes that you personally owe on the profits your company makes. There are two types of tax ID numbers for individuals.

Social Security Numbers

Social Security Numbers or SSNs identify you in the U.S. Social Security system, which provides money for adults ages 62 or over, people with disabilities, and blind people.

You can apply for an SSN if you have been lawfully admitted to the U.S. and are legally able to work in the country. Check out our article on how to apply for a social security card as a U.S. immigrant to learn more.

Individual Taxpayer ID Number

Individual Taxpayer ID Numbers (ITIN) identify people who work and pay taxes in the U.S. but do not qualify for Social Security Numbers.

If you are a resident with foreign status or an undocumented immigrant, you’ll need to apply for an ITIN instead of an SSN. Our guide on how to get an ITIN will walk you through the process step-by-step.

Employer Identification Number

An Employer Identification Number or EIN is a tax identification number for businesses. The IRS uses this number to identify businesses.

If your business will pay employees, you will need to obtain an EIN. In addition, an EIN is necessary if you need to file business tax returns on top of your personal tax returns.

You can apply for an EIN online. In most cases, you receive approval and get the number as soon as you finish the application.

State Tax Identification Number

In some cases, you will also need to obtain a state tax identification number to pay sales taxes or other taxes. Most states allow you to apply for this number online. You can visit your state’s department of revenue website for more information about which businesses require numbers and the ways that you can apply if you need one.

Do immigrants get tax breaks when they open a business?

Immigrants don’t receive any type of preferential tax treatment in the U.S. This means you won’t qualify for exclusive tax breaks when you open a small business.

However, all business owners in the U.S. may be able to deduct startup and organizational costs as capital expenses. IRS Publication 535 explains the types of capital expenses that qualify for deductions.

Do I need to pay an accountant to file taxes for my immigrant-owned business?

With the availability of tax preparation software and online services, many immigrant entrepreneurs wonder if they can file on their own and avoid paying accountant fees. While it’s true that preparing taxes yourself can save you money on preparation, you could face penalties or even end up in the middle of an audit if you file incorrectly.

Certified public accountant (CPA) stay up-to-date on regulations. They’re also able to spot potential legal tax breaks and provide you with advice on how you can structure your business and manage your expenses to lower your taxes in the future. The American Institute of CPAs offers a search tool to help you find licensed CPAs in your area.

Immigrant business owners can track many of their business expenses and handle other financial matters on their own. Finance apps can increase your control over your small business finances and make it simpler for you to track and analyze key financial data. Check out our list of Finance Apps for Immigrants and New Arrivals to the U.S. and U.K. to discover some of these time-saving planning apps so you can prepare to file and pay your taxes more easily.

Types of business structures

Sole proprietor

Sole proprietorship is the simplest type of business structure. It’s also what the government considers you if you don’t preselect a type of structure for your company when filing taxes.

In a sole proprietorship, you are your business. Your company is an extension of you so its assets and liabilities are yours.

In most cases, immigrant sole proprietors disclose their business assets and liabilities and pay taxes on profits as if they were income. You also pay self-employment tax to cover Social Security and Medicare taxes. (Keep scrolling down to the next section to learn more about this type of tax.)

Limited partnership

A limited partnership (LP) consists of two or more individuals who share ownership in a company. One partner has unlimited liability for the company’s debts and obligations. All other partners have limited liability. In this structure, the main partner has the most control over the business.

No matter which partner you are in a limited partnership, the profits you make from the business should be declared on your personal tax returns. All partners pay taxes on the profits as personal income. In addition, all partners must pay self-employment tax to cover Social Security and Medicare.

Limited liability partnership

With a limited liability partnership, all partners have limited liability. All of the partners also receive equal protection from business debts. This type of business structure ensures you’re not responsible for the consequences of actions taken by another partner.

The profits and losses of a limited liability partnership pass through to all partners’ personal income taxes. All partners may be subject to self-employment tax based on their role in the company and how much they participate in the operations of the business.

Limited liability company

A limited liability company (LLC) is a cross between a partnership and a corporation. Partners that form a limited liability company are known as members.

This business structure shields you and the other members from liabilities and allows you to avoid paying corporate taxes. Instead, profits and losses are passed through to your personal income taxes. Most LLC members also pay self-employment tax.