You need to build credit because your credit history and credit score affect many aspects of your life. For example, banks, lenders, insurance companies, cell phone providers, and other businesses check your credit score to determine your interest rates, annual fees, and more.

Even if you’re just looking for a new job or apartment, having a thin credit profile — meaning you don’t have enough credit history to generate a credit score — can prevent you from beating out other applicants.

Building a good credit score can be challenging, especially if your credit history is minimal. If you’re pursuing opportunities in a new country and need to establish yourself, there are several methods you can follow to build your credit history. Follow this guide to learn how to build credit in a new country, as well as understand the factors that can affect your credit score.

What is credit?

Credit is borrowed money that you pay back, usually with interest added. If you need to make a large purchase and don’t have enough cash on hand, credit can help you make the purchase and pay it off over time.

There are two types of credit for borrowers: installment credit and revolving credit.

Installment credit

Installment credit comes in the form of a loan with a set monthly payment and repayment period. Most loans, including mortgages, auto loans, student loans, and personal loans, are a form of installment credit.

Revolving credit

Revolving credit allows you to use a credit line up to a certain limit, pay it off, and use it again. There’s typically a minimum monthly payment, but no set repayment term. Credit cards, home equity lines of credit, and personal lines of credit are forms of revolving credit.

As you use either installment or revolving credit regularly and responsibly, you establish a credit history, which shows up on your credit report. Your credit score is a numerical representation of that history and gives potential creditors a snapshot of how responsible you are with credit.

The difference between credit scores and credit reports

You typically have one credit report from each of the three national credit bureaus: Experian, Equifax, and TransUnion.

When you take out a loan or use a credit card, the creditor typically reports your account activity to each of the three credit bureaus, which then organize that information on your credit report. Credit scoring companies, like FICO and VantageScore, use the information on your credit reports to determine your credit score.

Both the FICO and VantageScore credit scores range from 300 to 850. However, 90% of the top lenders in the U.S. use FICO, so it’s generally the one you want to know.

With that said, VantageScore, which many free credit monitoring services use, follows the same factors as the FICO Score in its calculations. As a result, the two scores are often similar.

What is a good credit score?

When you apply for a loan or a credit card, you’ll often notice that a lender shows a range of interest rates. This means that the rate you get is dependent on your creditworthiness, which includes how good your credit score is.

Depending on where you look, you’ll see different credit score ranges. That’s because different lenders have various interpretations of what they view as good credit.

According to FICO, here’s a good idea of what you can expect the ranges to look like:

- Exceptional: 800-plus

- Very good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: Less than 580

The average FICO credit score in the U.S. is 714.

The factors that influence your credit score

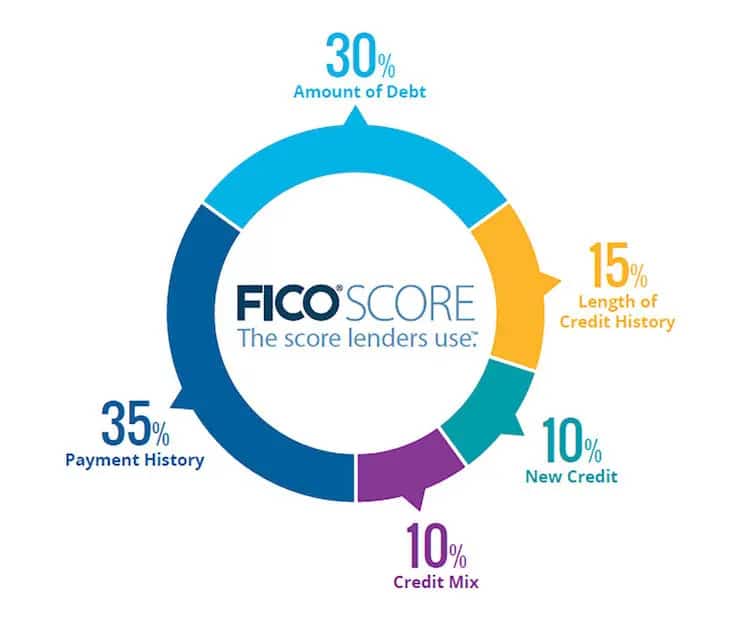

FICO calculates your score based on five factors, with some carrying more weight than others.

1. Your payment history

Your payment history makes up 35% of your FICO credit score, making it the most influential factor in your credit history. Essentially, it’s a measure of whether you’ve made your payments on time.

If you always make payments on time, your credit score will reflect that positively. But if you make late payments or allow your accounts to become delinquent, your payment history and credit score will suffer.

2. How much you owe

If you want to borrow money down the road but are already saddled with a lot of debt, lenders may balk at the request.

The same goes if you’re using a lot of the revolving credit that’s been extended to you. In fact, there’s a ratio — called the credit utilization ratio — that credit scoring models use to determine whether your revolving credit balances are too high in relation to your credit limit.

If your credit utilization ratio is high, it signals to lenders that you may be stretched thin financially and more likely to miss payments.

To determine your credit utilization, simply divide your balance by your credit limit. So, if you have a $2,000 credit card balance and a $5,000 limit, your credit utilization ratio is 40%.

To improve your credit, it’s best to keep your credit utilization ratio as low as possible, preferably in the single digits. This can be hard at first if you have a low credit limit, but over time, it will become easier when you qualify for better credit cards with higher limits.

This factor makes up 30% of your FICO credit score.

3. Length of credit history

This factor measures how long you’ve used credit. When you’re just starting out, it will take time and patience to build your credit history. But the good news is, this factor makes up only 15% of your FICO credit score.

In addition to considering your oldest credit account, another figure credit scoring models use to calculate your length of credit history is the average age of accounts. For example, if you open a new credit card account today, your average age of accounts is one month.

Over time, however, that average will increase. Then, once you apply for another card or a loan, the average will include the age of both accounts, making it go down.

As a result, it’s best to avoid opening new accounts unless necessary. Otherwise, it could drive down your average age of accounts and potentially hurt your credit score.

4. Credit mix

Lenders like to see that you can manage multiple types of credit. For example, having a credit card, an auto loan, and a mortgage is better than having just one type of credit.

This factor only makes up 10% of your FICO credit score, however, so don’t take out multiple loans just for the sake of boosting your credit score. It’s best to work on this over time as you naturally need different types of loans.

5. New credit

FICO also factors in how many hard credit inquiries you have on your credit report.

A hard inquiry occurs when you apply for credit, and a lender checks your score as part of the application approval process. While hard inquiries stay on your credit report for two years, they generally only influence your score for one year. The new credit factor makes up 10% of your FICO credit score.

Fortunately, though, soft inquiries won’t affect your credit score. This means that checking your own credit score or having a landlord or employer check won’t negatively affect your credit score. The same goes if a lender checks your credit to send you a pre-approval offer.

How long does it take to build credit?

Generally speaking, it can take at least six months to start building credit. It’s impossible to build credit fast. Lenders want to see a long history of financial stability, which means that it can take time to build credit and earn lenders’ trust.

However, if you’re trying to earn an excellent credit score, it can take longer. If you’re actively improving your credit score, it can take six months to two years to see a significant change.

How to build credit in 5 steps

Now that you know what goes into your credit score, it’s easier to establish good credit habits. Here’s how to build credit in a new country.

1. Get access to credit

It’s not easy receiving a credit account without a credit history, but it’s not impossible. Here are a few options to consider:

- Student credit cards: If you’re a college student, a student credit card is a great way to start building credit. These are unsecured cards, which means you don’t need a security deposit for approval. Also, some credit card companies offer rewards every time you use the card.

- Secured credit cards: If you’re not a college student or you aren’t approved for a student credit card, a secured card is a solid alternative. The main drawback to these credit cards is that they require a security deposit — typically equal to your credit limit — for approval. Otherwise, they function the same as regular credit cards.

- Authorized user status: If you’re looking to build credit quickly or you don’t want a credit card of your own, consider asking a trusted family member to add you as an authorized user on one of their credit cards. As an authorized user, you’ll get a card attached to the account, and the entire account history will go to your credit report. This is only a good idea if your family member has a good payment history on the account and keeps their balance relatively low.

- Credit-builder loan: If you want to avoid credit cards altogether, some lenders offer credit-builder loans to help you establish a credit history. The difference between this type of loan and a personal or auto loan is that you don’t get any money when the lender approves the loan. Instead, the lender will place the loan funds in a savings account or certificate of deposit. Then, once you’re finished making payments, plus interest, you’ll receive the loan amount.

If you’re learning how to build credit, keep in mind that rent and utility payments do not typically help you improve your credit. If you stop making these payments, however, your landlord or utility company could send your account to collections, which will damage your credit score.

2. Make payments on time every time

If you choose to get a credit card or a credit-builder loan, it’s imperative that you make on-time payments every month.

To make things easier, consider setting up automatic payments to come out of your checking account. Then, you don’t need to remember to make the payment each month.

The only caveat is that you’ll need to have enough cash in your checking account to avoid a failed payment on the due date. To prevent this, make it a habit to reconcile your bank statements every month to ensure you have enough money in your account to cover automatic payments.

And if you have a credit card, make it a goal to pay your balance in full each month by the due date instead of just the minimum payment. That way, you can build credit without paying interest.

3. Keep credit card balances low

If you decide to get a credit card, use it responsibly but sparingly to start. You’ll typically have a low credit limit — possibly just a few hundred dollars — so you’ll want to keep your credit utilization at a reasonable level. Over time, however, you can request a credit line increase or apply for a credit card with a higher spending limit.

4. Check your credit score

As you’re working to build your credit, check where you stand. If you have a credit card, the card issuer may offer free access to your FICO credit score. For example, Discover cardholders have access to a free credit scorecard.

Alternatively, you can access your VantageScore through free sites like Credit Karma and Credit Sesame.

Once you know your credit score, you can track your score over time. Credit score services will typically show you if anything is hurting your score and how to address it.

If you just moved to a new country, keep in mind that these credit monitoring services might not have a credit score for you yet. Check your score again after using credit for a few months.

5. Be patient

There’s no way to establish an exceptional credit history overnight. Even if you get a few different credit accounts to start building credit, it will take time to develop the right behaviors and prove that you’re a responsible credit user. You can expect it to take at least six months to see a change in your credit.

As you follow these steps, you’ll start developing a good credit history and setting yourself up for lower interest rates and better chances of getting your dream house, apartment, or job in the future.

Learn how to build credit to unlock more opportunities

So, how long does it take to build credit? It won’t happen overnight, but with consistency, you can build credit in a new country and open more doors for your family. To build your credit score, try:

- Accessing credit

- Making payments on time

- Keeping credit card balances low

- Checking your credit score

- Waiting at least six months