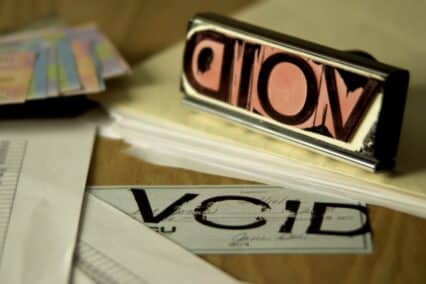

What Is a Voided Check and When Do You Need One?

When you're asked for a “voided check” while setting up direct deposit or automatic payments in the US, it might seem confusing, especially if you're new to the banking system. Why submit a check that can’t be used? At Remitly, we’re here to make this process clear and secure. This...