If you’ve moved from Morocco to work abroad, you’re in good company. It’s estimated that around five million Moroccans live in other countries, which amounts to around 14% of the population. And, if you’re sending money to Morocco, you’re also part of something big – in 2020 alone, the equivalent of $7.54 billion in remittances took place, making a significant contribution to the Moroccan economy.

Unfortunately, many Moroccans have had to put up with poor exchange rates and high transfer fees over the years. This is where Remitly comes in. We’re here to ensure sending money to Morocco is a fair, secure process which won’t cost over the odds. Convenience is key to what we do, so you can choose to make the MAD transfer to your recipient’s bank account, or you can make a Wafacash so your recipient can pick up the money in person. Here’s how.

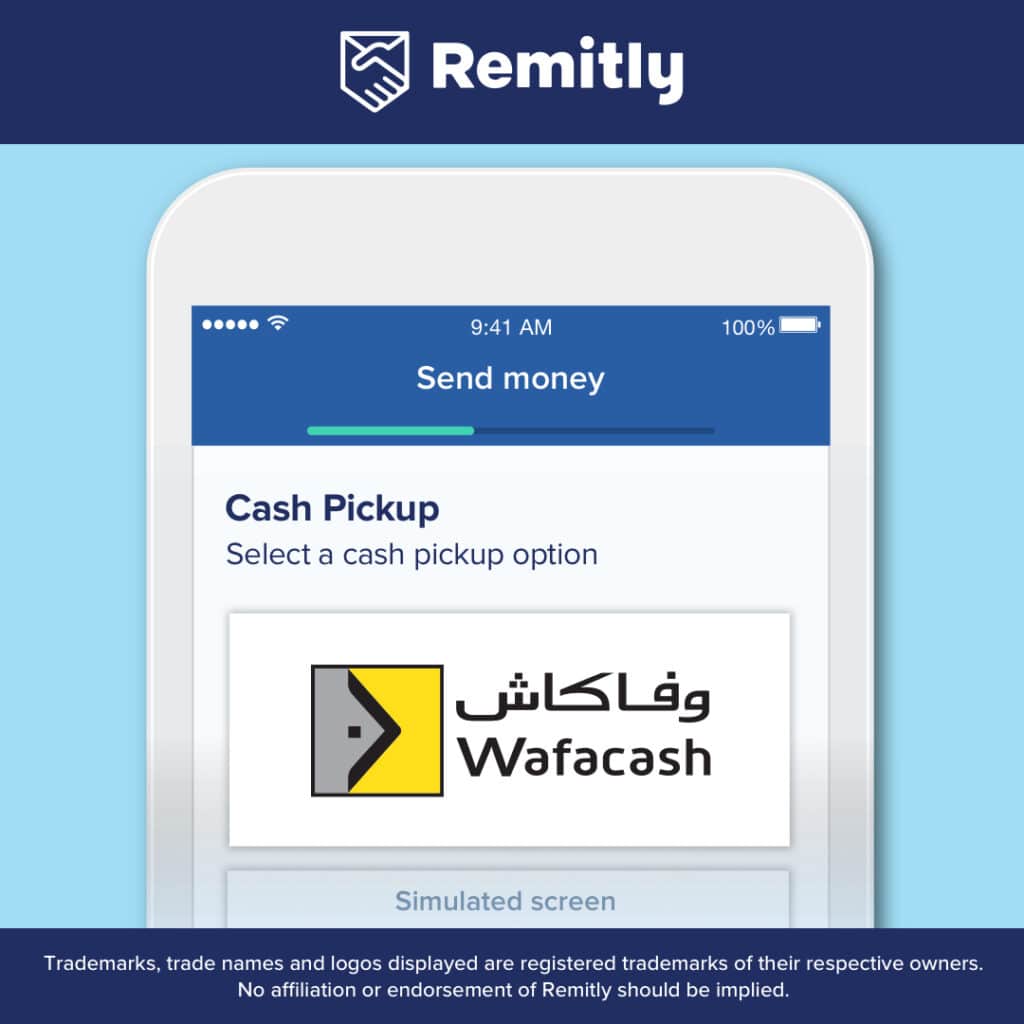

Send Money to Wafacash in 5 Easy Steps

If your friend or family member would like to collect Moroccan dirhams through a Wafacash transfer, here are the steps to follow.

- For first-time users, download the Remitly app and create a profile. Then select Morocco as your destination country.

- Enter the amount you wish to send.

- Choose Cash Pickup as your delivery method and Wafacash as your location.

- Enter your recipient’s personal details.

- Enter your payment details.

That’s all there is to it. After checking all the details are correct, you can complete the MAD remittance. You and your recipient can also enjoy extra peace of mind with our SMS updates which will track the process as it happens.

Why Should I Use Remitly to Send Money to Wafacash?

We know that your loved ones may depend on you for support, so sending money to Morocco should be a straightforward process that doesn’t bring you any hassle. With Remitly, you can be sure of transparent, fair fees and great exchange rates. Cancelling a MAD transfer for any reason? That’s not a problem – you’ll have your money sent right back if you cancel before the transfer completes.

How Quickly Will My Money Arrive with Wafacash?

Sending money to Morocco with Wafacash, you can typically expect the transfer to take less than 30 minutes. Bear in mind that exact timings can depend on your payment method and whether you take the super-fast Express route or the lower-fee Economy route.

How Much Money Can I Send to Wafacash with Remitly?

As an international money transfer provider, Remitly balances customer service with account security and international regulations. To do this, we have a sending limit when you first open your account.

If you need to send more than that, we will ask you for more information. For more about raising your sending limits, check out details here. Additional sending limits may apply depending upon your choice of payout partner or receiving location.

Is it Safe to Send Money to Wafacash with Remitly?

We’re very proud that millions of migrants all over the world trust us to handle their money transfers. We maintain that trust with strict safety processes which are overseen by an in-house team of online security experts. All personal data is protected with bank-standard encryption. To ensure total transparency, we also provide SMS/text notifications on money transfers, so you’ll know if there’s a problem and can request a refund straight away.

Discover more here about security at Remitly.

What We Love about Wafacash

Founded back in the 1990s, Wafacash is a subsidiary of the leading Morrocan multinational, Attijariwafa Bank, and has had a real impact on ordinary people’s lives. Its stated aim is to “increase financial inclusion of low income individuals” and “democratise financial services”, which it does by allowing users to pick up funds, in cash, at branches across the country.

It’s not just about simple convenience. The service provided by Wafacash can be a real lifeline for people who may not have access to traditional banking methods, yet need a way to receive remittances from loved ones living and working abroad. As Moroccans don’t need a bank account to pick up dirhams through Wafacash, this is a remittance solution that’s truly for everyone.

Furter reading: How To Safely Send Money to Morocco in 5 Easy Steps