According to the United Nations, about three million Ghanaians live abroad, with nearly one third of the Ghanaian diaspora residing in North America or Europe. Many of these individuals work hard to send money home to their loved ones, making Ghana the second-largest recipient of remittances in Sub-Saharan Africa. As of 2018, these remittances equaled 7.4 percent of Ghana’s GDP.

If you wonder how to safely send money to Ghana, you have several options. While you could go with a bank transfer or traditional money transfer services, fees can be high. Money transfer apps like Remitly are affordable and convenient, with straightforward pricing and secure transfers. Here’s how it works. Additionally, if you’re curious about how to send money to Morocco, similar options are available that prioritize security and low fees. Exploring various online money transfer services can help you find the best rates, ensuring your funds reach loved ones quickly and safely. Always compare services to make informed decisions that suit your needs. For those looking to expand their options further, you can also consider services that allow you to safely send money to Bangladesh. These platforms often provide competitive exchange rates and minimal fees, making it easier for you to support family and friends overseas. Remember to check customer reviews and ensure the service you choose has a solid reputation for reliability and security.

When using Remitly, you can use your smartphone to send your GBP, USD, EUR, or AUD to friends and family in Ghana, where they receive the funds as Ghanaian cedi (GHS). You have the option to send money directly to a bank account in Ghana, to a mobile wallet like MTN Mobile Money, or for cash pickup.

Ready to get started? Download the app and we’ll show you how.

Want to learn more? Read on.

Why Should I Use Remitly to Send Money to Ghana?

For one thing, Remitly is easy to use. After creating an account, you can send money from the comfort of your own home without having to travel anywhere and wait in line. Additionally, Remitly offers competitive exchange rates and low fees, making it an affordable option for sending money abroad. Users can send money to Indonesia securely, ensuring that their transactions are protected with advanced encryption technology. This means you can transfer funds with peace of mind, knowing that your financial information is safe.

Remitly offers bank-level security and encryption and competitive exchange rates for GHS, along with low fees and fast delivery.

Send Money to Ghana in 5 Easy Steps

You can send money to Ghana in five simple steps.

- For first-time users, download the Remitly app, create an account, and set Ghana as your destination country.

- Enter the amount you want to send for your first transfer.

- Select a preferred delivery method.

- Enter the recipient’s details, such as bank details and phone number. This information will differ for bank accounts vs. cash pick up vs. mobile wallets.

- Add your payment details, such as bank account, debit card, or credit card.

When creating an account, new customers need to verify their identity and bank details. In some cases, additional documentation may be required to verify your identity. You can learn more here.

What Banks/Providers Can You Send Money to With Remitly?

When sending money to Ghana, you can choose cash pickup, bank deposit, or mobile money at over 1,800 locations. With so many delivery options, it’s easy to find something convenient for your loved ones. Additionally, Remitly ensures that your transactions are secure, allowing you to safely send money internationally without worry. Each method is designed to provide quick access to funds, making it easier for your recipients to receive their money when they need it most. Explore the various options available to make your sending experience seamless and hassle-free.

As of this writing, you can use Remitly to make an online money transfer to these banks and providers in Ghana:

- MTN Mobile Money

- GCB Bank

- Ecobank

- Fidelity Bank

- Access Bank

- Absa

- Consolidated Bank Ghana

- First National Bank

- Republic Bank Limited

- ARB Apex Bank

- CalBank

And this is just to start. For the complete list, start a money transfer to Ghana and the app and you’ll be able to select your preferred option.

How Much Money Can I Send to Ghana with Remitly?

As an international money transfer provider, Remitly balances customer service with account security and international regulations. To do this, we have a sending limit when you first open your account.

If you need to send more than that, we will ask you for more information. For more about raising your sending limits, check out details here. Additional sending limits may apply depending upon your choice of payout partner or receiving location.

How Much Does It Cost To Send Money to Ghana with Remitly?

For the most up-to-date pricing on money transfers to Ghana, including current exchange rates, please check the Remitly website or app.

At the time of this writing, you’ll find zero transfer fees in the U.S. and the U.K.

- U.S. customers can send transfers to Ghana for $0.

- If you live in the United Kingdom, you can send transfers to Ghana for £0.

- For residents of Canada, the fee for Economy and Express transfers is just $0.99.

Is it Safe to Send Money to Ghana with Remitly?

Remitly ensures your information and your money are safe. Our commitment to security is one of the reasons millions of people use Remitly to send money home.

- Remitly is licensed to do business in the 17 sending countries and more than 100 receiving countries that we serve. Our licensors have high standards and require us to follow strict security and customer protection guidelines.;

- Remitly uses multiple levels of security so you can send money home with peace of mind. Your personal data is protected 24 hours a day through fraud monitoring and encryption.

- All accounts are verified with proper documentation;

- Remitly is dedicated to protecting your money and personal data; and

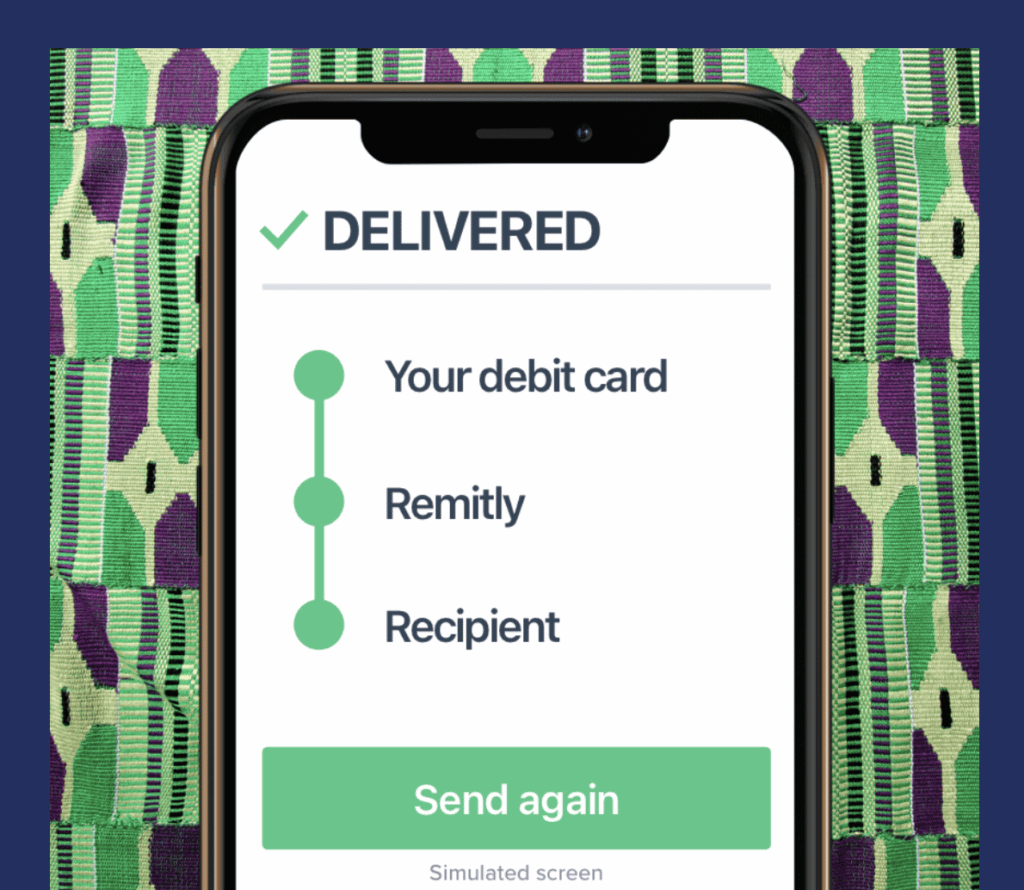

- You can track your transfer every step of the way.

More About Ghana

Globally recognized for its music, its rich history, and its regional influence, Ghana is a West African country home to approximately 32 million people. Migration rates are high in Ghana, with many seeking opportunities abroad. In 2019, just over 970,700 Ghanaians emigrated. While 47.3 percent went to other West African countries, 29.1 percent went to Europe and 20.5 percent went to North America. The top destinations in 2019 were Nigeria, the United States, and the United Kingdom.

Ghana’s modern-day economy is based on a mix of digital innovations, manufacturing, and natural resources like oil and gas. Considered one of the most stable countries in West Africa, Ghana gained its independence in 1957. The following year, the Bank of Ghana was formed, issuing its own currency in Ghana pounds, shillings, and pence.

In 1965, Ghana introduced cedi notes and pesewa coins. Since then, various denominations have entered circulation. Learn more interesting facts about the Ghanaian cedi here.