If you regularly handle checks, you may have noticed the small numbers printed on each one. While checks might feel old-fashioned in today’s digital world, they’re still widely used for paying rent, sending money internationally, or managing personal and business finances. Understanding check numbers can help you feel more confident managing your payments, whether at home or abroad, and keeping your banking organized. By learning how they work, you can manage your money more effectively, avoid mistakes, and spot potential issues early. In this Remitly guide, we’ll explain what check numbers are, where to find them, how they work, and why they matter for your financial security.

What are check numbers?

Checks have been part of the US banking system for centuries, serving as a reliable way to record payments. Over time, banks and companies integrated checks into accounting systems, so people could use them to pay rent, bills, and other obligations.

A check number, or check identification number, is a unique identifier printed on each check. Think of it as a serial number that helps both you and your bank track each transaction, ensuring that no two checks are confused.

Banks use a check numbering system to log checks. Each check has a unique, sequential number, making it easy to notice if a check goes missing. For example, the first check in your new checkbook might be 1001, the next 1002, and so on. No two checks in your account share the same number.

Why check numbers matter

Check numbers serve several purposes:

- Tracking your spending: Recording check numbers lets you see which payments have cleared, and which haven’t.

- Preventing fraud: Banks can use the unique numbers to identify duplicate or unauthorized checks.

- Organizing your finances: Whether you’re paying rent, bills, or business expenses, check numbers help you keep accurate records.

You might find it helpful to jot down each check number in your register before mailing or handing over a check. Even if you mainly use digital services like Remitly, understanding check numbers can help you integrate check payments into your broader financial routine, especially when sending money internationally or coordinating payments across borders.

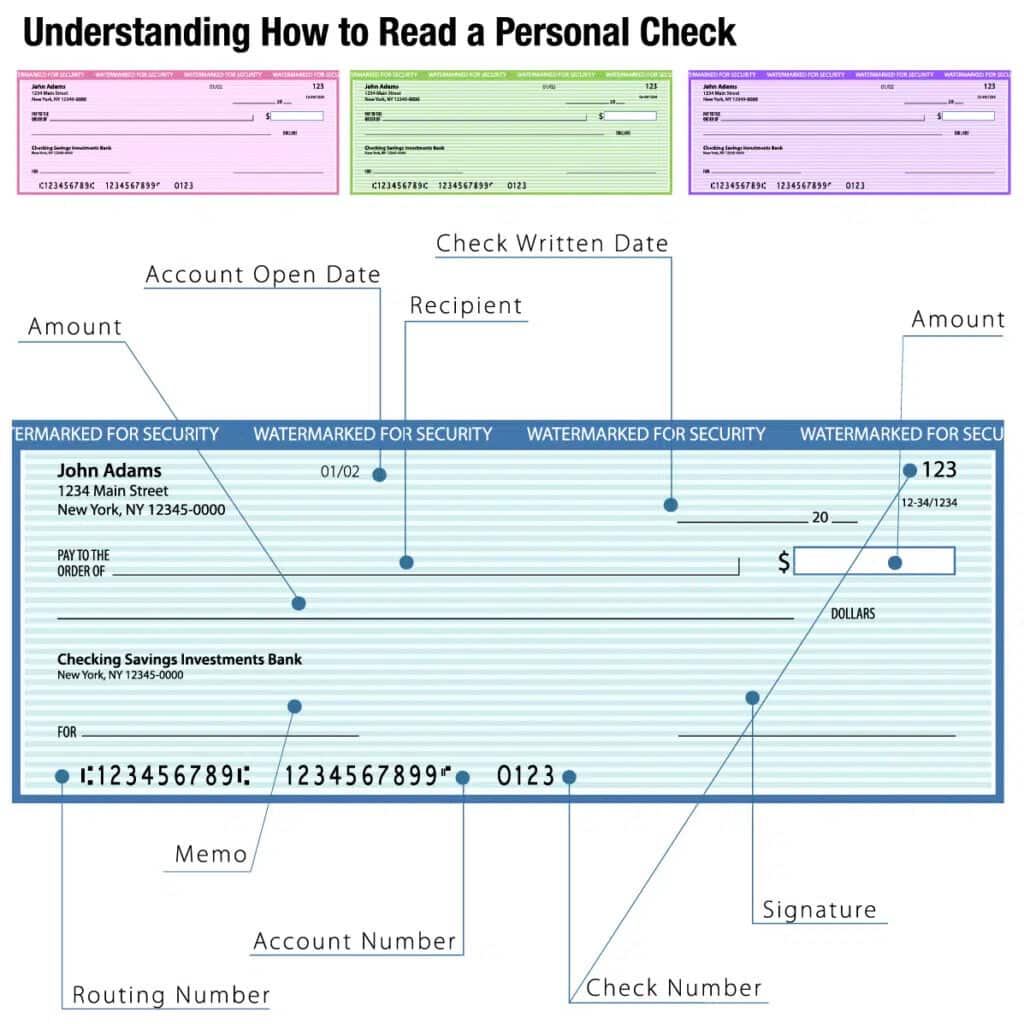

Where to find check numbers on your check

Check numbers appear in two places.

- Upper right corner, printed in large digits for easy identification.

- Bottom right in the magnetic ink character recognition (MICR) line, alongside your check number, bank routing number, and account number.

This line helps banks process checks efficiently, even when handling many at once. Introduced in the 1950s, MICR technology remains a standard part of banking today. If this line is damaged or smudged, your bank might reject the check.

Typically, personal check numbers are three to four digits long, while business checks may have longer numbers depending on the company’s accounting system. Knowing how to read check numbers can help you record them correctly, manage your checkbook, and track transactions with confidence.

How do check numbers work in banking?

Check numbers play a useful role in everyday banking operations.

Sequential numbering for accuracy

Sequential check numbers help banks and account holders log checks systematically, reducing errors. If check 1050 clears, then 1051 and 1052 should eventually follow. Noticing a missing number can alert you to a lost or stolen check.

Transaction tracking

Each check number is linked to a specific transaction. When a check is deposited, the bank records its number in your account history, creating a clear record. This is especially helpful for businesses, freelancers, or anyone reconciling monthly bank statements.

Preventing duplicate payments

Unique check numbers allow banks to detect and block attempts to process the same check more than once. This helps ensure recipients are paid correctly and that your money isn’t unintentionally withdrawn more than once.

Fraud detection

Monitoring check numbers helps you spot suspicious activity, such as duplicate numbers or gaps in the sequence. Checking your register regularly gives you an extra layer of security for your money.

Why check numbers matter for your financial security

Check numbers do more than keep your finances organized; they also help protect your money. Actively tracking them can prevent mistakes, spot fraud early, and make reconciling accounts easier. Here’s how:

Tracking cashed checks

Recording check numbers shows which checks have been cashed and which are still outstanding. This is useful when sending money internationally or for larger payments. For example, noting the check number for a security deposit check helps confirm your landlord received and deposited it correctly. For higher-value payments, such as tuition or large service fees, certified checks offer an extra layer of security.

Detecting missing or stolen checks

If you notice a gap in your check sequence, it could mean one was lost or stolen. Scammers sometimes use check washing to alter the payee and amount details. Tracking check numbers and reconciling them regularly with your bank statements helps you spot suspicious activity and take action, such as placing a stop payment on a missing check.

Maintaining accurate financial records

Logging each check number alongside the date, amount, and recipient allows for quick verification during account reconciliation. For businesses, freelancers, and anyone managing multiple accounts, this approach reduces errors, simplifies accounting, and keeps records complete.

Monitoring for fraud

Regularly reviewing check numbers alongside your bank statements can highlight unauthorized activity quickly. Fraudsters sometimes create counterfeit checks with random numbers, but consistent monitoring makes it easier to spot discrepancies before they result in financial loss. Even in today’s digital banking environment, staying attentive to your check numbers helps protect your money.

Common misconceptions about check numbers

Even experienced check users sometimes misunderstand how check numbers work. Clarifying these points can help you manage checks more confidently.

Checks don’t have to be written in order

You don’t have to write your checks in perfect numerical order. Banks will process them even if you jump from check 1010 to check 1015. However, sticking with a sequence makes it easier to spot missing checks.

Mistakes don’t have to disrupt your account

If you accidentally write the wrong amount or decide not to use a check, simply mark it “void” and record it. That way, your register stays accurate and you avoid confusing a voided check with one that was actually spent.

Check numbers don’t control whether a payment goes through

Payment processing depends on routing and account numbers in the MICR line. The check number is simply a tracking tool, helping with organization and security, not moving money.

Checks still matter in the digital age

Mobile deposit apps scan the MICR line to verify authenticity, and online banking dashboards display check numbers alongside transactions for easy reconciliation. Many landlords, schools, and small businesses still request checks because they create a paper trail that is easy to track.

Best practices for managing check numbers

To help make the most of check numbers, follow these practical steps:

- Keep detailed records: Log each check number, date, amount, and recipient in a check register. If you’re paying recurring bills, jot down the purpose too, so you’ll always know what each check was for.

- Store unused checks securely: Keep them in a locked drawer or safe to prevent theft, especially if you have multiple checkbooks.

- Organize your checkbook: Maintain a logical sequence and reconcile with bank statements, at least monthly, to catch discrepancies quickly and ensure all checks are accounted for.

- Report suspicious activity: If you suspect a check has been stolen or misused, contact your bank immediately. They can place a stop payment on the check to protect your account.

- Verify check validity: Some checks expire after six months, so check with your bank before assuming a check is still valid.

- Use tracking tools: Spreadsheets or financial apps can help you monitor check numbers alongside payment details.

Even if you prefer digital banking, mobile apps often record check numbers automatically when you deposit them. Many banks now allow you to download your transaction history, which includes check numbers, making it simple to cross-reference with your register. Setting aside time each month to reconcile both your digital and paper records helps you spot problems early, avoid double payments, and maintain peace of mind that your accounts are accurate.

Using check numbers effectively

Check numbers help you maintain accurate financial records, prevent duplicate payments, and stay organized. If you’re managing finances across countries or sending international remittances, understanding check numbers can give you peace of mind that your money reaches the right place safely. Staying mindful of check numbers is a small but meaningful step toward better financial management.

FAQs

What happens if I write checks out of order?

You can write checks out of order, but it can make it harder to track transactions and detect missing or stolen checks. If you do, be sure to record each check carefully in your register or tracking system.

Can I start my check numbers at a different number?

Yes, many banks allow custom starting numbers for a new checkbook. This can be helpful if you want to continue numbering from a previous checkbook or organize checks by type (personal vs. business). Check with your bank if you want to start at a specific number.

How do banks use check identification numbers to process payments?

Banks scan the MICR line, which includes the check number, to process checks. Check numbers act as a unique identifier for each transaction, helping banks track deposits, prevent duplicate processing, and maintain accurate records. This ensures that every check can be traced if any issues arise.

What should I do if I lose a check or checkbook?

Contact your bank immediately, record the missing check numbers, and consider placing a stop payment on any checks that might be at risk. Additionally, review your recent transactions for unauthorized activity and update your register or tracking system to account for the missing items.

Do electronic checks have check numbers?

Yes, electronic checks also include check numbers for tracking and record-keeping. These numbers help reconcile online deposits, track payments, and maintain a clear audit trail, just like paper checks.