For anyone navigating the world of international finance or travel, understanding various currencies is key. One currency that often sparks curiosity is the Netherlands Antillean guilder. Although not as globally recognized as the dollar or euro, it plays a central role in the economy of certain parts of the Caribbean, making it an important currency for anyone dealing in that region.

This blog will give you a comprehensive overview of the Netherlands Antillean guilder, explain its origins and usage, and provide insight into how you can exchange this currency efficiently. Along the way, we’ll also explore its role in the world of remittances.

What Is the Netherlands Antillean Guilder?

The Netherlands Antillean guilder (ANG), also known as the florin, has its roots in the former Netherlands Antilles. This group of islands in the Caribbean was a part of the Kingdom of the Netherlands until its dissolution in 2010. Today, the guilder is used as the official currency of Curaçao and Sint Maarten.

Unlike many currencies, the guilder is pegged to the US dollar at a fixed exchange rate. This peg, at approximately 1 USD = 1.79 ANG, has helped stabilize the currency and maintain its value over time.

The Benefits of Using ANG

Stability Due to the USD Peg

One of the most significant advantages of the guilder is its fixed peg to the US dollar. This helps maintain economic stability in Curaçao and Sint Maarten, making the currency dependable and less prone to rapid fluctuations.

Widely Accepted Locally

If you’re traveling or doing business in Curaçao or Sint Maarten, the guilder is widely accepted alongside the US dollar. This dual-acceptance simplifies transactions by providing flexibility for tourists and locals alike.

Ease of Conversion

Thanks to its fixed peg, converting ANG to USD and vice versa is straightforward. Many exchange services also cater specifically to visitors, making it easy to adapt to the local currency.

How to Exchange ANG

There are several ways to exchange Netherlands Antillean guilders efficiently. Here’s what to consider:

Currency Exchange at ATMs

If you’re visiting Curaçao or Sint Maarten, withdrawing ANG directly from ATMs is one of the most convenient options. Just ensure your bank supports international transactions to avoid unexpected fees or issues.

Exchange Services and Banks

Banks and licensed currency exchange offices also provide reliable conversion options. Remember to check the applicable fees and rates before exchanging to maximize value.

Online Money Transfers

For individuals who need to send money to or from Curaçao and Sint Maarten, online money transfer services can securely handle guilder transactions. If this is your goal, consider reading our guide to international money transfers for tips on safety and efficiency.

Currency Exchange Abroad

If you’re outside of Curaçao and Sint Maarten and need guilders, check specialized currency exchange offices or online platforms. These services often work with exotic currencies like the ANG.

ANG in Remittances

For many residents, remittances play an essential role in daily life. Families in Curaçao or Sint Maarten often rely on money sent from loved ones abroad. Many money transfer services allow remittances in ANG or their USD equivalent, facilitating the seamless support of families and businesses.

Remittances also boost economic stability in the region. Studies show that this inflow of funds contributes to household income while encouraging spending within local economies.

If you’re looking to send money home, you may find helpful tools like how to send money safely an invaluable resource. Platforms like Remitly offer straightforward, safe, and budget-friendly transfer options.

Fun Facts About the Guilder

- Same Symbol, Different Currency

The Netherlands Antillean guilder uses the same currency symbol, “ƒ,” as its European cousin, the Dutch guilder, did before the adoption of the euro.

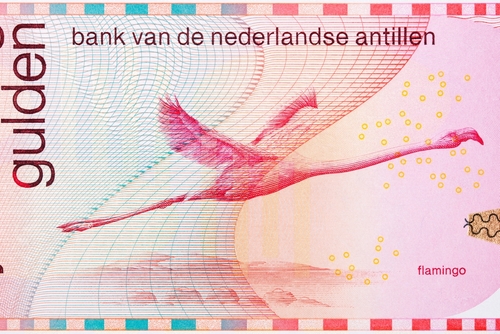

- Unique Banknote Designs

ANG banknotes often feature vibrant, colorful designs highlighting the cultural and natural beauty of Curaçao and Sint Maarten.

- Coins vs. Notes

ANG coins and notes are both commonly used in transactions. Coins include denominations as small as 1 cent, while notes go up to 250 guilders, allowing flexibility for various transaction sizes.

A Look to the Future

While Curaçao and Sint Maarten continue to rely on the guilder, discussions occasionally arise about adopting the euro or solely using the US dollar. However, as of now, the guilder remains a proud representation of the region’s history and autonomy.

FAQs About the Netherlands Antillean Guilder

1. Is the Netherlands Antillean guilder the same as the Aruban florin?

No. While both currencies share historical roots and the same symbol (ƒ), they are separate. Aruba, an autonomous region, uses the Aruban florin (AWG), which is pegged to the US dollar at a different fixed rate.

2. Where can I exchange ANG outside of Curaçao and Sint Maarten?

Some specialized currency exchange offices and international airports may offer exchanges for ANG. However, it may be easier to exchange US dollars, which are more universally accepted, and then convert them to guilders locally.

3. Are ANG and USD used interchangeably in Curaçao and Sint Maarten?

Yes, both currencies are widely accepted, allowing tourists and residents to transact in the currency they prefer.

4. Is ANG a stable currency for savings or investments?

Thanks to its fixed peg to the USD, the guilder remains relatively stable. However, it’s less commonly used outside of its regions, making it niche for savings or investments.

5. Can you use Remitly to send money directly in ANG?

Absolutely! Remitly supports various currencies, including ANG. Check out our step-by-step guide to sending money internationally for detailed instructions.