In today’s global economy, choosing the right service provider for international money transfers is as crucial as having a reliable internet connection. Whether you’re sending USD from Canada, handling international payments to Europe, or transferring funds to Australia, exploring WorldRemit alternatives like Remitly can simplify the process. Let’s dive into what makes each service unique.

WorldRemit Login Problems: A User-Friendly Alternative

Struggling with WorldRemit’s login? You may be trying to send money via their website, which is no longer an option. They’ve switched to focusing on app-only transfers. If you prefer a web-based transfer experience, consider Remitly. Right from our website on your phone or desktop computer, you can log in and start a transfer, choosing from a variety of payment options,* including credit card and bank transfer.

Why Remitly?

- Competitive Fees: Transparent and minimal fees for cost-effective transfers.

- Updates on Transfers: Real-time notifications keep you informed.

- Recipient Convenience: Extensive network for cash pick up and bank deposits.

- Security: Top-notch data protection with 24/7 customer support.

Guide to Sending Money with Remitly Online

Embarking on your money transfer journey with Remitly is a straightforward process, whether you’re a first-timer or a seasoned money sender. Here’s a step-by-step guide.

Getting Started with Remitly:

First things first, you’ll need to set up your Remitly account. If you’re a newcomer, welcome aboard! Signing up is a breeze. For mobile users, the Remitly app is available for download on both the App Store and Google Play Store. Desktop users, you’re not left out – simply head over to Remitly.com to get started.

Understanding Your Recipient’s Preferences:

Before you dive into sending money, have a chat with your recipient about their preferred method of receiving funds. Remitly offers various delivery options, but these can vary depending on where your recipient is located.

What You’ll Need for the Transfer:

- Your recipient’s full name, as shown on their ID.

- Accurate address and phone number of your recipient.

- If opting for a bank deposit, your recipient’s bank account number and the bank’s name are essential.

Setting Up Your Transfer:

Here’s how to get your transfer rolling:

- Initiating the Transfer: Log in to the Remitly app or website and select ‘Send’ or ‘Get Started. For web users, click on ‘Send money’.

- Choosing Transfer Details: Enter the amount you wish to send. Remitly will display the equivalent in the recipient’s local currency. Then, select a delivery method. Depending on your choice (like Bank Deposit or Cash Pickup), you may need to provide additional details like the recipient’s bank account information or a pickup location.

- Recipient Information: Input your recipient’s name and, if desired, their phone number for notification purposes.

- Completing Your Profile: Your own details are next – name, phone number, address, and date of birth. Make sure these match your ID for verification purposes.

- Payment Method: Select how you’d like to pay for the transfer, whether through a bank account, credit or debit card, or another method. This can vary based on your location.

Finalizing the Transfer:

- Review and Send: Double-check all the details in your transfer summary. If you need to edit anything, now’s the time. Once you’re all set, hit ‘Send Money’.

- Stay on the Page: Remain on the processing screen until it completes. You might need to provide additional information.

- Post-Transfer Process: Once your transfer is on its way, Remitly will send a confirmation receipt to your email. We’ll keep you updated on the status of your transfer and notify you once it reaches your recipient.

Popular WorldRemit Alternatives

In addition to Remitly, these money transfer services are well known.

Wise (Formerly TransferWise)

- Service Overview: Wise offers borderless banking with a focus on bank-to-bank money transfers.

- How It Works: Users can hold and convert money in multiple currencies and send money internationally.

- Key Features: Known for its multi-currency account.

Western Union

- Service Overview: A longstanding player in the money transfer market, offering global money transfer services.

- How It Works: Send money online, via the Western Union app, or in-person at locations worldwide.

- Key Features: Offers a wide range of payment options including cash pick up and direct transfers to local bank accounts.

PayPal/Xoom

- Service Overview: PayPal, with its service Xoom, specializes in online payments and international money transfers.

- How It Works: Users can send money, pay bills, and reload phones from the United States to various countries.

- Key Features: Xoom allows for money transfers, bill payments, and phone reloads.

MoneyGram

- Service Overview: A global provider of money transfer and payment services.

- How It Works: Money can be sent online or in-person for cash pick up, direct to a bank account, or to a mobile wallet.

- Key Features: Known for its global network.

OFX

- Service Overview: OFX specializes in international money transfers.

- How It Works: Users can transfer money to over 190 countries in various currencies.

- Key Features: Offers 24/7 support and an online transfer process.

Revolut

- Service Overview: Revolut offers a digital banking alternative with a focus on currency exchange, cryptocurrency exchange, and debit cards.

- How It Works: Allows users to hold, exchange, and transfer money in multiple currencies at the interbank exchange rate.

- Key Features: Known for its multi-currency accounts and spending analytics.

Sending Money Online: App vs Website

When it comes to international money transfers, not everyone is keen on navigating through a mobile app. That’s where Remitly stands out from WorldRemit. While WorldRemit has shifted to an app-only approach, Remitly continues to embrace the versatility of choice. Our desktop and mobile web platforms are as robust and user-friendly as our app.

There’s a certain charm to using web-based platforms for money transfers. They offer benefits that resonate with many of our customers.

Bigger Screen, Better Navigation: The larger screen size of desktops and laptops offers clearer visibility and easier navigation. This is especially beneficial for complex transactions where detail is key.

No App Downloads Required: Skip the hassle of downloading and updating apps. Access Remitly’s services directly through your browser, saving you time and device storage.

Familiarity and Convenience: Using a browser means you can leverage saved bookmarks, passwords, and auto-fill information. This familiarity breeds comfort and efficiency, making the money transfer process a smoother affair.

By offering both web and app platforms, Remitly ensures that everyone has access to easy, secure, and efficient money transfer services.

FAQs on WorldRemit Alternatives

Is WorldRemit the Same as Remitly?

No, WorldRemit and Remitly are different entities. While they both specialize in international money transfers, each has its unique offerings, fee structures, and operational methodologies. Remitly is known for its user-friendly app and desktop platform, whereas WorldRemit has recently shifted to an app-only model.

Why Is WorldRemit Not Working?

WorldRemit has made a strategic decision to focus solely on its mobile application for money transfers, discontinuing support for mobile web and desktop platforms. This means users can now only send money using the WorldRemit mobile app, which may affect those who prefer using a web browser or desktop for their transactions.

Where Is WorldRemit Located?

WorldRemit’s headquarters is located in London, United Kingdom. The company has a significant global presence, offering money transfer services to various countries around the world.

Where Is Remitly Located?

Remitly is headquartered in Seattle, Washington, United States. Like WorldRemit, Remitly serves a global customer base, providing international money transfer services across multiple continents.

Are Money Transfer Apps Safe?

Yes, money transfer apps are generally safe when they use standard security protocols. Most reputable money transfer companies, including Remitly and WorldRemit, employ bank-level encryption to protect user data. Additionally, they implement measures like two-factor authentication to enhance security. However, it’s always advisable for users to follow best practices in cybersecurity, such as using strong passwords and being cautious of phishing attempts.

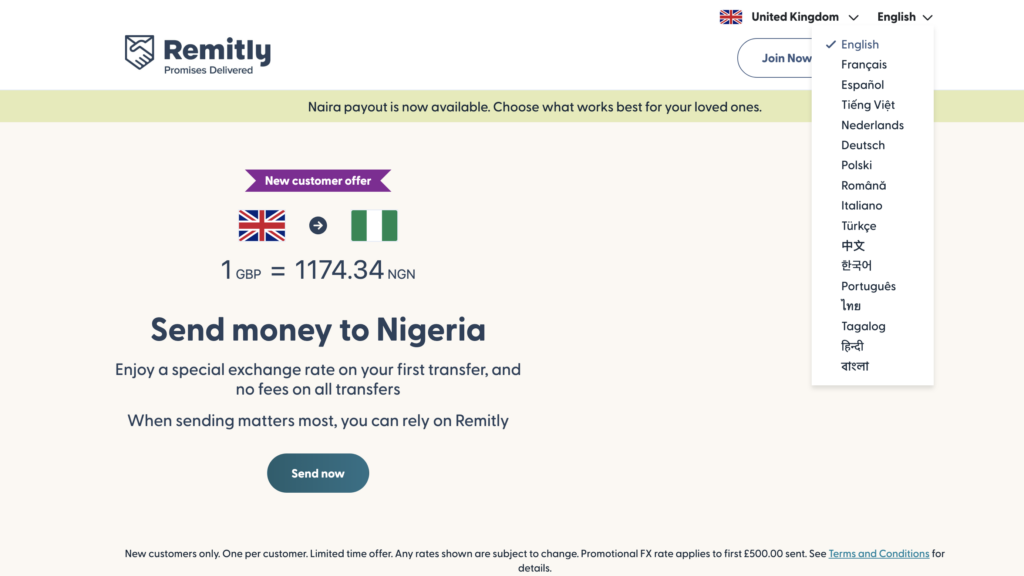

How Many Languages Are Supported by Remitly?

You can use Remitly in a total of 17 languages. Check out our website for your options.

Sample screenshot of Remitly’s website with the language menu.

Conclusion

Choosing the right money transfer service provider is key, whether for business transactions, remittances, or supporting loved ones. From Remitly’s user-friendly app and competitive fees to Wise’s multi-currency account and Western Union’s global reach, each service offers unique benefits. Consider factors like fees, exchange rates, payment options, and security to find the best fit for your international money transfer needs.

Remember: In the world of money transfers, knowledge is as valuable as your funds.