Guyana, with its stunning natural beauty and growing oil wealth, has a fascinating economic history. Whether you’re planning to visit or sending money to family and friends, understanding the Guyanese dollar (G$ or GYD) is essential for managing your finances.

Here’s everything you need to know about Guyana’s currency, its history, and its role in the country’s economy.

What Is the Guyana Currency?

The Guyanese dollar (GYD) is the official currency of Guyana, issued by the Bank of Guyana, the country’s central bank. The symbol G$ is used locally to denote prices. Unlike the West African CFA franc, the Guyanese dollar operates on a floating exchange rate.

The History of Guyana and Its Currency

Early History

Before European colonisation, Guyana was inhabited by indigenous peoples who called it “guiana,” meaning “land of water.” In the late 16th century, the Dutch colonised the region, introducing currencies such as the guilder.

British Colonial Period

In 1831, Guyana became part of the British Empire, known as British Guiana. During this period, British coins and banknotes circulated, including unique coins like the 4-pence piece, which was minted exclusively for British Guiana.

Post-Independence

After gaining independence in 1966, Guyana introduced its own currency. Over time, smaller coin denominations were discontinued, replaced by higher-value coins and notes.

Current Banknotes and Coins in Guyana

Banknotes

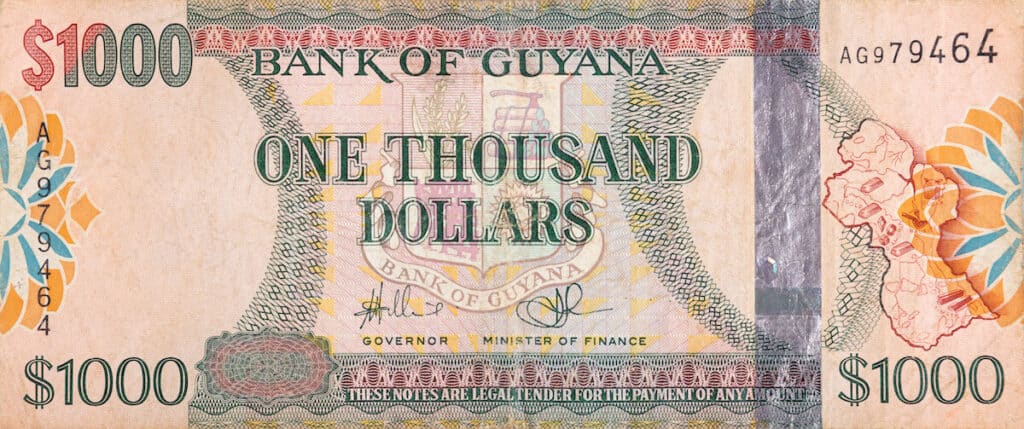

The Bank of Guyana issues notes in the following denominations:

- $20, $50, $100, $500, $1,000, $5,000

Coins

Coins are available in these denominations:

- $1, $5, $10, $100

Banknotes feature tactile elements to help visually impaired individuals identify denominations.

Five Key Facts About Guyana’s Currency and Economy

1. Only the Bank of Guyana Issues Currency

The Bank of Guyana manages the country’s monetary policy and issues all coins and banknotes. It also oversees pensions and other financial services.

2. Cash Is King in Guyana

While credit cards may be accepted in tourist areas, cash is the primary payment method across the country. It’s essential to carry local currency when visiting smaller towns or rural areas.

3. Security Features Enhance Banknotes

In 2019, the Bank of Guyana introduced new $1,000 banknotes with advanced security features, including Crane Currency’s RAPID micro-optic thread, to combat counterfeiting.

4. Oil Discoveries Have Boosted Guyana’s Economy

Since 2015, oil field discoveries have significantly boosted Guyana’s GDP. The country is now one of the fastest-growing economies in the world.

5. Agriculture Is a Key Economic Sector

Agriculture contributes nearly 30% of Guyana’s GDP, producing crops like rice, sugar, and cocoa. The country’s coastline also supports a thriving seafood and fisheries industry.

Understanding Guyanese Currency Exchange Rates

The Guyanese dollar is a free-floating currency, meaning its exchange rate fluctuates based on market conditions. It is not pegged to any major currency like GBP, USD, or EUR.

Example Exchange Rate

At the time of writing, £1 is approximately 260 GYD. To calculate the amount you’ll receive when exchanging GBP to GYD, use a currency converter or your money transfer app.

Sending Money to Guyana

For those sending money to Guyana, services like Remitly offer fast and affordable options. Funds can be sent directly to local banks or for cash pickup, providing flexibility for recipients.

Download the app to get started and enjoy competitive exchange rates and transparent fees.