Ever wanted to write a check but wondered what all those numbers at the bottom actually mean? Even in today’s digital banking world, paper checks are still commonly used for important payments such as rent, bills, or direct deposits.

Knowing what the account number on a check means helps you use them correctly and avoid costly mistakes. That’s why we’ve created this Remitly guide to clearly explain what an account number is, where to find it on a check, and why it matters.

What is the account number on a check?

An account number is a unique set of digits that identifies your individual bank account, whether it’s checking, savings, or a different type. You can think of it as your account’s address within the bank’s system.

These numbers tell the bank exactly where to take funds from when you make a payment and where to deposit money when it comes in. It links all your financial transactions directly to your specific account, making sure your money ends up in the right place.

Where is the account number on a check?

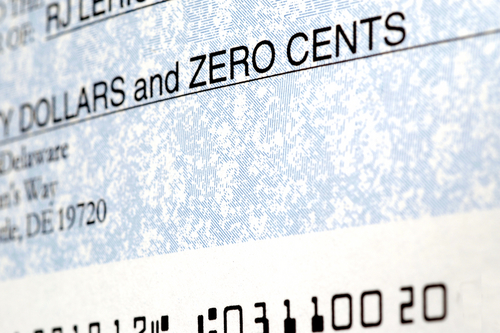

To find your account number on a check, it helps to know what all the different numbers at the bottom mean. Each set of digits serves a different purpose—here’s how to tell them apart:

The routine number

At the bottom left of a check, the first set of nine digits is the routing number. It identifies the financial institution that holds your account, making sure your money is routed accurately. You can think of it as your bank’s postal code within the financial system.

Routing numbers are used for many transactions, such as processing checks, setting up direct deposits, or sending wire transfers. Everyone who banks at the same financial institution shares the same routing number.

The account number

If you’ve been asking yourself, “What is the account number on a check?” Look for the middle set of numbers, right after the routing number. In the US, account numbers typically range between 8 and 12 digits, though some banks use as few as 5 to as many as 17.

Each bank creates its account numbers differently, often for security and organizational purposes. Your account number is unique to you or your business, and remains the same on all your checks, making it easy to spot and recognize.

The check number

The last set of numbers at the bottom right is the check number. It matches the number in the top-right corner of your check and helps you keep track of each payment.

Check numbers make it simple to stay organized and monitor your spending. Each number is unique within your checkbook, so you can quickly identify individual transactions at a glance.

Other ways to find your account number

Even if you don’t have a physical check to hand, there are several easy ways to find your account number.

Online banking portal or mobile app

You can easily find your account number by logging into your bank’s online portal or mobile app. Check sections like “Account Summary” or “Account Details,” where your account number is usually displayed for quick reference.

This method is safe and convenient, letting you view your account anytime without waiting for mail or visiting a branch. Just make sure you log in using a secure network to protect your private details.

Bank statements

Your account number appears on every monthly bank statement, whether paper or digital. It’s usually near the account summary or in the header or footer of the statement.

Even past statements can serve as a reliable reference if you need your account number. This method provides a permanent record you can return to whenever you need it.

Calling your bank

You can also call your bank’s customer service to get your account number. After verifying your identity with personal information like your Social Security number or date of birth, they can provide the information.

This option is ideal if you don’t have online access or a physical check. Always use the official phone number listed on your bank’s website or statements to ensure safety.

Visiting a branch in person

If you prefer face-to-face help, visiting a bank branch is a solid option. Bring a valid ID and the staff will verify your identity before providing the information.

This method gives you immediate access and the chance to ask any other questions about your account while you’re there.

Bank correspondence and welcome letters

When you open a new bank account, your account number is usually included in welcome letters, deposit confirmations, or other official correspondence from the bank.

Keeping these documents in a secure place makes it easy to reference your account number anytime, even if you don’t use checks or online banking regularly. This is a handy option for anyone who prefers having a physical record on hand.

Why is your account number important?

Now that you know where to find the account number on a check, let’s take a close look at why the numbers matter and how to use them.

Setting up direct deposits

To get your paycheck directly into your bank account, employers need both your routing number and account number. This way, your salary arrives safely and on time without dealing with paper checks. Direct deposits are convenient, reduce the risk of lost or stolen checks, and let you access your money immediately on payday.

Making automatic payments

Your account number is also needed to set up automatic payments for bills, subscriptions, loan repayments, and other recurring expenses. Automatic payments make it easier to stay on top of due dates and prevent late fees. They simplify your monthly routine and help keep your credit in good standing by ensuring payments are made on time.

Setting up alerts and notifications

Your account number lets your bank send instant alerts for deposits, withdrawals, low balances, or unusual activity. You can also customize alerts to focus on transactions that matter most to you. These notifications help you spot errors or suspicious transactions quickly. Staying informed in real-time gives you greater control over your finances.

Simplifying account management

Your account number makes it easier to view and manage multiple accounts in one place. You can monitor balances, track spending, and plan your budgets without switching accounts. This helps you see the full picture of your finances without hassle.

Linking financial services

Many apps and payment platforms need your account number to connect securely to your bank. Linking your accounts allows you to transfer money, pay bills, and manage your finances seamlessly across different services. It saves time and reduces the risk of errors in online transactions.

Verifying transactions

Your account number is key for double-checking deposits, withdrawals, and transfers. It helps ensure all transactions match your record and are correctly processed. Using it to verify activity makes resolving discrepancies faster and simpler.

Requesting a refund or chargeback

Your account number is essential if you ever need to request a refund or file a chargeback. When a payment is disputed, your bank uses your account number to locate the correct account and process the reversal securely. Keeping accurate records and knowing your account number helps ensure refunds or chargebacks are processed smoothly.

Security

Your account number is sensitive information, and keeping it private is key to protecting your money. Even though banks have strong security measures, never share your account number publicly or with unverified sources. Being careful with your account number helps reduce the risk of fraud and gives you peace of mind.

What to do if you lose or suspect misuse of your account number

If your account details are lost, stolen, or you notice suspicious transactions, act quickly to prevent potential fraud:

- Contact your bank immediately: Report the issue so your bank can freeze or monitor your account to stop further unauthorized activity.

- Change your online banking details: Update your login passwords, security questions, and PINs right away. Use strong unique passwords and enable two-factor authentication for extra protection.

- Review your recent transactions: Flag any payments or withdrawals you don’t recognize. Keep a record of disputed transactions to make follow-ups easier with your bank.

- Request a new account number: In serious cases, your bank can close the compromised account and issue a new one. Update any automatic payments or deposits linked to your old account to avoid disruptions.

Find and use your account number easily

Your account number connects all your transactions to your specific account and is usually the middle set of numbers at the bottom of a check, between the routing and check numbers. Knowing this number makes your transactions accurate, secure, and stress-free.

Finding and using your account number is simple. You can locate it on a physical check, in your online banking portal or app, bank statements, or by contacting your bank directly. These are safe and easy ways to access it when needed.

When you understand your account number and how it works, you can manage your money confidently and handle transactions without mistakes or stress.

FAQs

Is the account number the same as the check number?

No. Your account number identifies your specific bank account, but the check number tracks a single check from your checkbook.

Can two people have the same account number?

No. Every account number is unique, even for customers at the same bank. This uniqueness makes sure your money always goes to the right place without confusion.

Is it safe to give out my account number?

It’s generally safe to share your account number with trusted sources, such as your employer or utility company. But never share it with anyone you don’t know or can’t verify. Always double-check that the request is legitimate to avoid unauthorized access.

Can I change my account number if needed?

Yes. If there’s ever a security issue or suspected fraud, your bank can close the compromised account and give you a new one. Be sure to update automatic payments, deposits, and any linked services.

Does the account number ever expire?

No. Your account number stays the same as long as your account is active. Even if you get a new checkbook or debit card, your account number usually doesn’t change unless you specifically request it.

Where else might I need my account number besides checks?

You’ll need your account number for things like electronic transfers, linking your bank to apps or payment services, and setting up automatic payments. It’s also important when verifying your identity with your bank or resolving any transaction issues.