You’ve been saving up your money, and you’re ready to put down a deposit on a new apartment or rental property — but the property manager wants to see proof of income first.

Renting an apartment is just one scenario in which you may need to provide proof of income documents. Banks, utility companies, and credit card companies may also require income verification before you can open an account with them.

Some visas also have an income requirement, such as the pensioner visa in Panama.

Proof of income is simply documentation that shows how much you earn over a certain period of time. Typically, you’re being asked for proof of a steady source of income.

These can include bank statements, pay stubs, tax returns, and other legal documents.

Read on for more detail.

9 common proof of income documents

1. Pay stub

A pay stub is usually the easiest way to show proof of income. That’s because it shows the income you earned during a specific pay period as well as your year-to-date (YTD) income.

Since a pay stub is an official document from your employer, it may be enough to serve as proof of income without additional income verification documents.

However, if you’ve only started your job recently, have multiple jobs, or earned income from tips or commissions that aren’t shown, it may not give the full picture.

2. Tax return

The next best thing is a copy of your most recent income tax return. In the U.S., that will be the federal tax return you’ve filed with the IRS.

Tax returns are a reliable way to verify your income because they’re a legal document that includes your income from both earned and unearned sources.

The downside to using a tax return is that it shows your income from the previous tax year and doesn’t prove that you still have the same job or sources of income.

3. Bank statement

A bank statement can be used to back up other documents, such as to prove that your self-employment income is genuine. A bank statement shows the total balance of your bank account as well as any transactions you’ve made during that time period.

This is a great way to show regular cash flow, such as monthly deposits from a client or employer, or proof of significant savings.

If you’re worried about sharing too much personal information, ask if you can provide a statement of balance only or omit sensitive purchases.

4. Court-ordered payments

Court-ordered payments include things like child support and alimony. If you don’t have a record of these payments already, you can request them from the court.

These documents can help prove that you can afford to pay rent, even if you don’t have employment-based income.

5. Unemployment benefits or worker’s compensation

If you aren’t currently working, but receive unemployment payments, worker’s compensation, or disability insurance, you can use this as proof of income.

Simply request the relevant documents from your insurance company, state unemployment division, or employer.

6. Pension distribution or Social Security benefits

The Social Security Administration sends monthly Social Security payments to eligible retirees, while pensions are retirement benefits that are common in some professions, such as education, local government, and the military.

You can access a Benefit Verification Letter from your Social Security account online, or use your Pension Distribution Statement (1099-R) as proof of income.

7. Profit and loss statement

Self-employed individuals may have a harder time providing an income statement, especially if your income varies over time. For example, maybe you’re a freelance graphic designer who only gets paid when you complete a project.

If that’s the case, you can provide a profit and loss statement from an accounting tool like Wave or Xero, or a statement of earnings from a platform like UpWork. Although these aren’t legal documents, they can serve as evidence of cash flow.

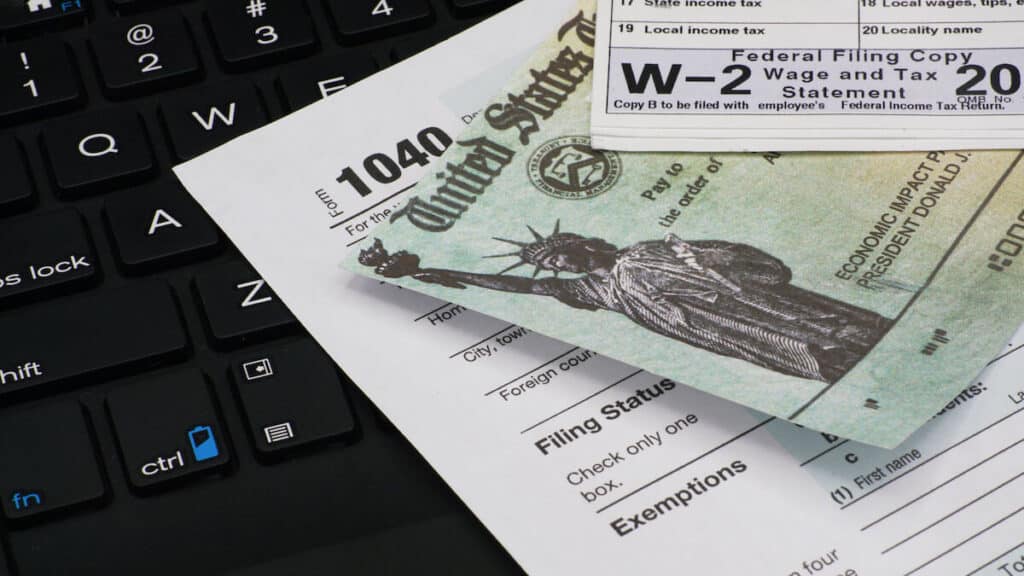

8. W-2 or 1099-MISC forms

Another option is to provide tax documents, such as a W-2 or 1099 tax form. This is a practical option if you haven’t filed your tax return yet, or your income has changed since you last filed your taxes.

You’ll receive a W-2 tax statement from any employer who paid you more than $600 per year, including any part-time employment.

If you’ve received any self-employment income, you should receive a 1099-MISC form at the end of the tax year.

9. Proof of income letter

Finally, if none of these proof of income documents are a good fit, you could ask your employer to write a proof of income letter.

This could be useful if there are gaps in your employment documents related to a sabbatical or leave of absence, or if you have an unusual compensation package that isn’t reflected on your pay stubs.

Your employer can verify that you do, in fact, work for them and confirm your salary or the length of your employment with them.

How to show proof of income

The best way to show proof of income depends on your employment situation and the reason for the request.

Your proof of income documents should state your full name, the date, and any other identifying information, such as your ID number or Social Security number.

An application may request proof of income from a specific time, such as the last three months or the previous year. If you have a full-time job, then your proof of income documents should show how much you earn during each pay period.

For self-employed individuals, you may need to provide proof of income over a longer period to show that your income remains consistent over time.

Different types of income

In some cases, you may also need to distinguish between different sources of income.

Earned income is money you earn from a job, such as wages, salaries, and tips, while unearned income includes bank interest, unemployment benefits, and pensions.

Some retirement visas want evidence of unearned income to show that you can support yourself without having a job in your new country.

Housing and proof of income

Although there isn’t a hard and fast rule on how much a prospective tenant has to earn, financial experts recommend that renters pay 30% or less of their monthly income on rent.

In most cases, landlords want to make sure you earn enough to cover your rent and still pay for expenses.

The tenant screening process may also require a background check or credit score as part of your rental application, depending on the laws in your country or state.

Do you need to make international money transfers to friends or family who live in different parts of the globe? Remitly makes it easy with a convenient mobile app and a transparent fee structure. Download the app today to get started.