Emergency savings funds play a critical role in helping individuals navigate unexpected financial challenges, such as medical emergencies, job loss, or urgent home repairs. As such, financial literacy is paramount for Americans and anyone immigrating to the States.

However, recent statistics highlight a concerning trend in the United States: a significant portion of the population lacks sufficient savings to cover basic emergency expenses. According to data from various studies, such as those by Bankrate and JPMorgan Chase, many Americans are unprepared for financial shocks, which can lead to increased debt or even financial instability.[1] [2]

You may wonder, ‘How much emergency savings should I have?’ This page delves into the current state of emergency savings across the country, examining the gaps in savings, regional disparities, and the growing need for improved financial preparedness.

Emergency savings in the US: Key facts you need to know

- The average American emergency savings fund is around $16,800.

- Nearly 40% of Americans aren’t prepared to handle a $400 emergency expense.

- Younger Americans struggle more to have emergency savings.

- Americans typically save nearly $1,000 per month on average.

- Less than half of Americans met or exceeded their savings goals for 2024.

- California has six cities in the top 10 places where Americans need the largest emergency fund.

- 83% of hourly workers in the US have less than $500 in savings.

- A quarter of Americans would rather use a credit card for unexpected expenses.

- Americans are saving less than 5% of their income in 2024, down from 32% in 2020.

Statistics on the average emergency savings fund

Analyzing data from Empower, the Bureau of Labor Statistics (BLS) and The Federal Reserve System, we will illustrate the state of the average emergency savings fund in the US. [3] [4] [5]

The average American emergency savings fund is around $16,800

At first glance, an average emergency fund balance of $16,800 may seem reassuring, but it doesn’t tell the whole story. Because high-income savers inflate the average, many Americans have much less in savings. In reality, many Americans struggle to save and live paycheck to paycheck.

According to the BLS, the average American salary is around $65,470 before taxes, meaning an average emergency fund would cover approximately three months of a person’s gross income, falling within the recommended range.

However, this amount may not cover three months’ expenses in more expensive areas.

Almost a third of Americans have no emergency savings

Nearly one in three Americans has no emergency savings, a significant financial vulnerability. Without any savings to fall back on, unexpected expenses like medical emergencies, car repairs, or job loss can lead to people relying on high-interest debt, payday loans, or financial hardship.

In addition to the 27% of Americans who claimed they had no emergency savings, 29% stated they had enough to cover less than three months of bills.

The remaining 44% had enough emergency savings to cover three to six months of bills and expenses, further highlighting the financial disparity in the US.

Nearly 40% of Americans aren’t prepared to handle a $400 emergency expense

For nearly 40% of Americans, a sudden $400 expense, such as a medical bill, car repair, or home emergency, would be financially devastating. Many would have to borrow, use credit cards, or sell personal items to cover the cost.

This statistic reflects the number of Americans living on the financial edge, where even minor unexpected costs can disrupt their stability.

It also underscores the importance of employer-sponsored savings programs, financial education, and policies that help individuals build small but crucial financial buffers.

American households should have an emergency fund worth 6 months of expenses

Financial experts recommend having three to six months’ worth of living expenses in an emergency fund, but for most households, the higher end of this goal remains out of reach.

With rising costs in housing, healthcare, and daily expenses, many people struggle just to cover their basic needs, let alone build an emergency fund of this size. This can be a problem even in the lowest-cost-of-living cities in the US, where issues like lower wages and limited job opportunities become factors.

While six months of savings provides strong financial security, many Americans must significantly change their income, budgeting habits, and financial planning to reach this target.

Most Americans (56%) consider their emergency savings fund and their savings account separate

Many Americans distinguish between their emergency savings fund and general savings account, with 56% keeping them separate. This suggests that most prioritize emergency savings as a financial safety net rather than a general-purpose fund.

However, the 44% who do not separate their savings may be at greater risk of depleting their reserves for non-essential expenses. Notably, 21% of Americans used their emergency fund for holiday spending, highlighting how financial pressures can lead to dipping into funds meant for unexpected crises.

Maintaining financial discipline and reinforcing the importance of structured budgeting is crucial to prevent emergency savings from being used for discretionary purchases.

Average emergency savings by age

We’ll cover the generational state of emergency savings in the US by analyzing studies such as JPMorgan Chase’s “How vulnerable are Americans to unexpected expenses?”. [2]

60% of Americans aged 60+ have three months of emergency savings

When looking at the average emergency savings by age, older Americans, particularly those aged 60 and up, are the most likely to have at least three months of emergency savings.

This trend is mainly due to decades of financial experience, more stable careers, and reduced financial burdens like mortgage payments or childcare expenses. Many older adults also prioritize financial security in preparation for retirement, making emergency savings a key focus.

Younger Americans struggle more to have emergency savings

In contrast, younger Americans between 18 and 29 are less likely to have substantial emergency savings. Just 39% of Americans in this age group admitted they had an emergency savings fund to cover three months of expenses.

Younger Americans struggle to build emergency savings due to student loan debt, lower salaries, and rising housing costs.

Many Gen Z and younger millennials are early in their careers, earning lower wages while managing rent, debt, and daily expenses. Many young adults find putting money aside without substantial disposable income challenging, leaving them vulnerable to financial shocks.

Baby boomers tend to have the most emergency savings at $22,190 on average

Baby boomers generally have the most significant emergency savings balances on average among all generations. This is often due to higher lifetime earnings, homeownership, and decades of financial planning.

Many boomers have also benefited from pensions, employer-sponsored retirement plans, and a historically lower cost of living during their peak earning years. Their financial stability allows them to weather unexpected expenses more easily, though some may still face challenges in retirement, especially if living on a fixed income.

Gen Z has the lowest average emergency savings

Unsurprisingly, Gen Z holds the lowest average emergency savings among all generations, at just $9,459.

Many are just starting their careers, often in entry-level positions with modest salaries, and face high living costs, student debt, and limited savings opportunities.

Additionally, some Gen Zers prioritize investing over traditional savings, putting their money into stocks or cryptocurrency rather than building a cash emergency fund. While this can offer long-term benefits, many lack immediate liquidity for sudden financial needs.

Half of Americans aged 35-54 could cover a $1,600 unexpected expense

Half of Americans aged 35-54 can cover a $1,600 emergency expense using cash from their savings. A further 16% in this age group could cover the expense with cash and disposable income, making them the most prepared age group.

This age group often faces high financial pressures, including mortgage payments, childcare costs, and retirement savings. While some have built solid emergency funds, others struggle with debt, stagnant wages, or financial obligations that make saving difficult. This statistic suggests that while most mid-life Americans are financially prepared, many are still at risk of hardship from unexpected expenses.

Millennials had to cover living expenses with emergency funds more than any other generation

Millennials have faced unique economic challenges, making them the most likely to rely on emergency savings for everyday expenses, with 65% dipping into their funds.

Many millennials entered the workforce during the 2008 financial crisis, dealt with stagnant wages, and faced rising housing costs, student loan debt, and inflation. Unlike baby boomers, who often benefited from lower home prices and stable pensions, millennials frequently lack long-term financial security, leading them to use emergency savings just to get by rather than for true emergencies. This highlights the growing need for financial planning resources, wage growth, and accessible savings strategies to help people build sustainable economic stability.

Average emergency fund contributions

Regular contributions to your emergency savings are paramount in building a financially suitable cushion should the worst happen. This section will look at how often and how much Americans tend to contribute to their emergency savings, using studies from Nerd Wallet and Empower.

Americans typically put almost $1,000 into savings on average per month

On average, Americans save around $1,000 per month, but this figure doesn’t tell the whole story. Savings habits vary widely by income level, expenses, and financial obligations, meaning while some households save significantly more, many struggle to set aside anything.

Maintaining a steady savings habit can be challenging with inflation and rising living costs, and unexpected expenses often take priority. While this figure suggests strong financial discipline among some, it also highlights the gap between those who can afford to save and those who cannot.

Almost 9 in 10 Americans save regularly

Nearly 90% of Americans save regularly, highlighting widespread financial awareness. There are many different types of savings accounts that could be used for these savings. A survey by CNBC Select and Dynata in September 2023 shows that 57% of Americans use a traditional savings account, likely for instant access. On the other hand, less than one in five (18%) use a high-yield savings account.

However, regular saving doesn’t always equate to sufficient saving, as many individuals contribute small amounts sporadically rather than building a structured emergency fund. While this statistic is a positive indicator of financial awareness, it also highlights the need for consistent saving strategies to ensure people are adequately prepared for future economic challenges.

Less than 15% of Americans incorporate emergency savings into their monthly budget

Further highlighting the sporadic and unstructured nature of Americans’ savings attempts, less than 15% of Americans incorporate emergency savings contributions into their monthly budget.

This suggests emergency savings often take a backseat to immediate expenses and discretionary spending. However, without a structured approach, many people are unprepared for unexpected costs, leading to reliance on credit cards or loans.

Experts recommend treating emergency savings as a fixed expense to ensure consistent contributions.

The most common reason for savings contributions is for emergencies

While people save for many reasons, such as retirement, vacations, home ownership, or other significant purchases, emergency preparedness is the most common motivation.

This indicates that despite many Americans seemingly having unstructured savings plans, there is widespread awareness of financial risk.

However, despite this awareness, many Americans still lack a sufficient emergency fund. The challenge lies in balancing day-to-day financial responsibilities with long-term security, making structured, automated savings plans a valuable tool for economic stability.

Less than half of Americans met or exceeded their savings goals for 2024

Although many Americans set savings goals at the beginning of the year, fewer than 50% met or exceeded them in 2024.

This shortfall reflects financial challenges such as inflation, stagnant wages, and unexpected expenses that force people to dip into their savings. Many individuals start with ambitious financial resolutions but struggle to maintain consistency. This highlights the importance of realistic goal-setting and automated savings contributions.

More than three-fifths of Americans are confident of meeting financial savings goals in 2025

Despite falling short of savings goals in 2024, looking ahead, over 60% of Americans feel confident about achieving their savings targets in 2025. This signals plenty of optimism about financial security.

However, optimism alone isn’t enough. External factors such as economic conditions, job stability, and inflation will influence whether these goals are realistically attainable. Financial experts suggest setting clear, measurable goals, automating savings, and adjusting budgets to stay on track throughout the year to improve the chances of success.

Average emergency savings by city

Below, we’ll examine emergency savings funds in many of the major cities in the US. We’ll primarily look at research carried out by GoBankingRates, which shows the amount needed for three, four, five, and six months’ worth of emergency savings for the 50 most populous cities in the US. [6] The general recommendation for an emergency savings fund is six months, simply to provide people with a significant financial cushion in the event of unforeseen expenses or losing a job. In the case of the latter situation, it’s even more important, as it’s hard to estimate how long it will take to find a new job, so the more you have in emergency savings, the better.

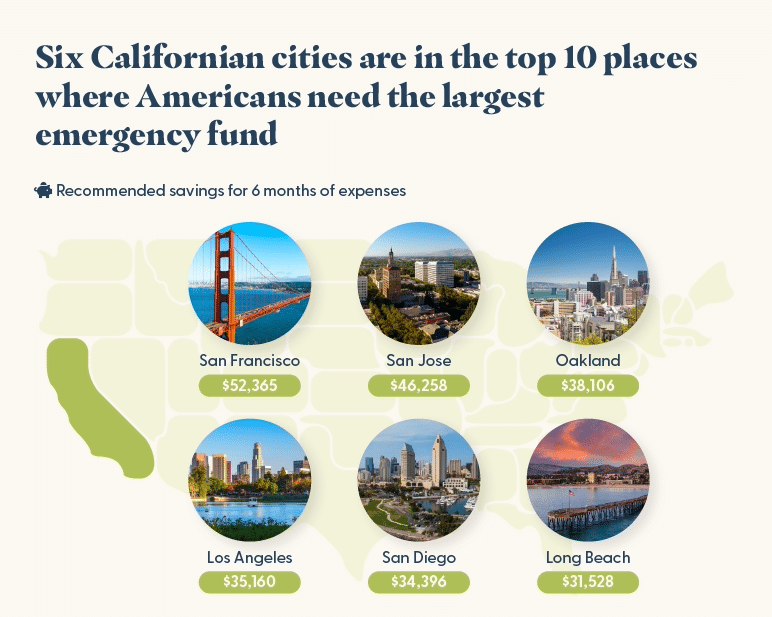

San Francisco is the city with the highest emergency fund needed to cover 6 months’ expenses

This should be no surprise, given that San Francisco is known for its higher cost of living. When looking at the average emergency savings by city in the US, you’d need around $52,365 to cover six months of expenses in San Francisco, which is around $6,000 more than the city that requires the next highest emergency savings fund, San Jose.

Housing costs alone likely make up a significant chunk of this figure, with median rent prices far exceeding national averages. For San Franciscans, building a robust emergency fund is even more critical, as unexpected financial setbacks can quickly become unmanageable without sufficient savings.

California has six cities in the top 10 places where Americans need the largest emergency fund

California’s high cost of living and expensive housing market make it home to six of the top ten cities where Americans need the largest emergency funds. San Francisco requires the highest emergency fund per month. Other California cities in the top ten include San Jose, Oakland, Los Angeles, San Diego, and Long Beach.

The state’s higher-than-average housing, utilities, and transportation expenses make financial preparedness crucial for Californians, particularly those living in urban areas where costs continue to rise.

Detroiters need the lowest emergency fund among the biggest cities in the US

In contrast, Detroit is the most populous US city with the lowest necessary average monthly emergency fund, at around $2,183. This is much lower than the $8,727 per month needed in San Francisco.

Lower housing costs and a more affordable overall cost of living mean that Detroit residents can get by with a smaller financial cushion than those in more expensive areas. While affordability is a financial advantage, economic challenges such as job availability, the average unemployment rate in the city was 4.7% during December 2024, higher than the US average of 4.1%, and income disparities still play a role in residents’ ability to build and maintain an emergency fund.

New York City and Los Angeles residents need over $30,000 to cover six months of expenses

Living in the US’s two largest cities, New York City and Los Angeles, comes with a hefty price tag, including rent, food, transportation, and healthcare costs.

As a result, residents in these metro areas need over $30,000 in emergency savings to cover six months of living expenses. The high financial threshold underscores why many New Yorkers and Angelenos struggle to save adequately, as everyday costs consume a significant portion of their income, leaving little room for long-term financial security.

Average emergency savings by profession

This section will examine statistics that portray the state of emergency savings in the US by different professions and income levels. We’ll analyze data from studies such as those by The Federal Reserve System and Branch’s report on the finances of hourly workers in the US. [5] [7]

Low and moderate-income households are less likely to have emergency savings

Building an emergency fund is often challenging for low and moderate-income households due to high living costs and limited disposable income. As such, 43% of households in the US earning less than $60,000 a year admit they have no emergency savings.

Workers in service industries, childcare, food service, and retail frequently earn wages that barely cover essentials like rent, groceries, and transportation, leaving little room for savings.

Without a financial cushion, these individuals are more likely to rely on credit cards, payday loans, or borrow from family when unexpected expenses arise. Expanding access to higher wages, financial education, and employer-sponsored savings programs could help these workers build economic resilience.

Just 12% of American households earning more than $200k have no emergency savings

Among high-earning workers, such as doctors, lawyers, corporate executives, and tech professionals, only 12% report having no emergency savings. However, these individuals typically have higher disposable income, stable employment, and access to financial planning resources, making it easier to prioritize savings.

It is important to note that even at this level, some individuals face financial challenges due to high living costs, expensive mortgages, school tuition, or investment losses. This highlights that while income is a key factor in economic stability, financial discipline, and budgeting also play a crucial role in building a solid emergency fund.

83% of hourly workers in the US have less than $500 in savings

A staggering 83% of hourly workers, including those in retail, hospitality, warehouses, and gig economy roles, have less than $500 in savings. An additional 50% also admitted to having no emergency savings fund.

Many jobs provide inconsistent hours, low wages, and minimal benefits, making setting aside money for emergencies difficult. Without savings, even small financial shocks, such as a flat tire, a missed shift, or a medical bill, can create a crisis, forcing workers into high-interest debt or economic instability. More employer-matched emergency funds and easier access to financial literacy programs could help these workers achieve greater financial security.

Emergency fund usage statistics

You may wonder what the most common financial burdens are that force people in the US to use their emergency savings. Well, this section will go over what Americans tend to spend their emergency savings fund on.

Around three in five Americans have used their emergency savings fund to cover basic living expenses within the last year

Nearly 60% of Americans use emergency savings not just for unexpected crises; they’ve become a lifeline for daily expenses.

This trend reflects the increasing financial strain on households, with rising costs in housing, groceries, utilities, and transportation forcing many to dip into their savings just to stay afloat.

Emergency funds should be reserved for job loss, medical bills, or major repairs, but stagnant wages and inflation make long-term financial security challenging for many Americans. Many risk depleting their funds entirely and turning to debt for future emergencies without consistent savings habits.

Medical issues are the most common reason people use their emergency funds

Healthcare costs remain a significant financial burden, with medical emergencies being the top reason 29% of Americans tap into their emergency savings.

Even with insurance, unexpected expenses such as high deductibles, out-of-pocket costs, and unpaid sick leave can quickly drain an emergency fund. The US healthcare system’s high costs leave many individuals choosing between using savings or going into medical debt. This highlights how critical it is for households to plan, explore Health Savings Accounts (HSAs), and build robust emergency funds for healthcare-related expenses.

A quarter of Americans prefer using credit cards for unexpected expenses over savings

When facing unexpected financial shocks, 25% of Americans opt for credit cards instead of emergency savings.

This reliance on debt suggests that many people either don’t have sufficient savings or prefer to keep their cash untouched despite the risk of high interest rates and long-term debt accumulation.

While credit cards can offer a short-term solution, they often lead to costly repayment cycles, making it harder to recover financially. Experts recommend prioritizing cash savings over credit reliance, ensuring financial stability without adding to debt burdens.

Changes in US emergency savings

The percentage of adults with emergency savings fell from 59% in 2021 to 54% in 2023

After reaching a peak of 59% in 2021, the share of adults with at least three months’ emergency savings has since declined to 54% in 2023.

This spike in savings was likely driven by pandemic-related factors, such as government stimulus checks, reduced spending opportunities, and increased financial caution. However, as the economy reopened, inflation surged, and the cost of living rose, many Americans dipped into their savings to cover everyday expenses.

The decline since 2021 suggests that while more people were financially prepared during the pandemic, the pressure of rising prices, rent increases, and wage stagnation has made it harder to maintain emergency funds. This decline highlights the difficulty Americans face rebuilding savings after the pandemic.

Americans 60+ with an emergency savings fund have increased by 15% since 2015

Older Americans have become significantly more financially prepared over the past decade, with a 15% increase in those aged 60+ holding emergency savings since 2015.

This growth is likely due to a strong focus on retirement planning, rising life expectancy, and past economic experiences emphasizing financial security. Many in this age group have already paid off mortgages and benefited from stable employment before retirement, allowing them to allocate more toward savings. However, with healthcare costs rising and inflation impacting fixed incomes, maintaining adequate savings remains a key challenge for retirees.

For the younger generation, it’s not all doom and gloom. Over the same period, the number of Americans aged between 18 and 29 with emergency savings has grown by 11.43%.

The proportion of Americans able to cover a $400 unexpected expense has declined since 2021

The ability of Americans to handle small financial shocks has weakened since 2021, signaling increased economic strain.

While government stimulus and reduced spending during the pandemic helped boost savings temporarily, the combination of inflation, higher living costs, and stagnant wages has made it harder for many to keep even a modest financial cushion.

Without emergency savings, more households rely on credit cards, loans, or cutting essential expenses to cover unexpected costs, increasing their financial vulnerability.

Americans are saving less than 5% of their income in 2024, down from 32% in 2020

Similarly, the personal savings rate has plummeted from a pandemic high of 32% in 2020 to below 5% in 2024, reflecting a sharp shift in financial behavior.

During the early stages of COVID-19, reduced discretionary spending and economic uncertainty drove record-high savings rates. However, as inflation rose and housing costs increased, plus the resumption of student loan payments, many Americans were left with less room to save. This decline underscores the growing difficulty of maintaining financial security and highlights the importance of prioritizing emergency savings amid economic uncertainty.

Challenges to building emergency savings funds

The US has endured some rather turbulent financial times, especially over the last few years, with the pandemic and increasing inflation rates. As a result, many Americans have struggled to build and maintain an emergency savings fund.

But what are the main barriers preventing Americans from preparing for unexpected expenses?

A recent survey by New York Life Wealth Watch revealed that Americans cite inflation and credit card debt as their most significant financial concerns for 2025. [8] The fear of credit card debt is very real for many Americans, as 67% admitted to having some kind of debt, with credit cards being the most prevalent. Other debts included mortgage and medical debt.

Additionally, 73% of Americans said they were saving less due to inflation, the rising cost of living, or a change in income. Consumers are increasingly concerned about inflation, which may rise further due to new tariffs on trade partners.

This combination of factors underscores many Americans’ financial insecurity as they struggle to cover day-to-day expenses, pay off debts, and build an emergency savings fund. However, saving even a small amount of money, such as $25 a week, is a good place to start during economic hardship.

Rainy day funds vs. emergency funds

A rainy day fund and an emergency fund are similar but serve different purposes. The terms are often used interchangeably, but the subtle difference is that an emergency fund is cash set aside for unexpected or urgent expenses, such as a loss of income, while a rainy day fund covers smaller expenses like a surprise bill or home appliance replacement.

How much should you have in your rainy day fund? Unlike an emergency savings fund, which should cover 3-6 months of expenses, a rainy day fund is often smaller. Between $1,000 and $5,000 is a good starting point, as it doesn’t have to cover weeks or months of costs.

Regarding what Americans spend their rainy day fund on, major household repairs and car expenses take the top spot. A further 24% of Americans use their rainy day fund for medical emergencies, and 16% on the cost of living increase. This highlights how rainy day funds are often used for unforeseen yet relatively predictable emergencies such as those above, whereas an emergency savings fund covers more significant, more catastrophic expenses.

Sources

[1] https://www.bankrate.com/banking/savings/emergency-savings-report/

[2] https://www.jpmorganchase.com/institute/all-topics/financial-health-wealth-creation/how-vulnerable-are-americans-to-unexpected-expenses

[3] https://www.empower.com/press-center/37-americans-cant-afford-emergency-expense-over-400-according-empower-research

[4] https://www.bls.gov/oes/current/oes_nat.htm#00-0000

[5] https://www.federalreserve.gov/consumerscommunities/sheddataviz/emergency-savings-table.html

[6] https://www.gobankingrates.com/saving-money/savings-advice/minimum-emergency-savings-needed-in-50-largest-us-cities/

[7] https://get.branchapp.com/resources/2022-branch-report-pdf

[8] https://www.newyorklife.com/newsroom/2025/wealth-watch-2025-outlook

Other sources used in this analysis:

https://fortune.com/2023/04/19/gen-z-millennials-boomers-gen-x-emergency-savings-breakdown/

https://www.federalreserve.gov/publications/files/2023-report-economic-well-being-us-households-202405.pdf

https://www.lendingtree.com/debt-consolidation/emergency-savings-survey/

https://www.cnbc.com/select/americans-not-using-high-yield-savings-accounts/

https://www.nerdwallet.com/article/banking/data-2023-savings-report

https://www.bls.gov/opub/ted/2025/unemployment-rates-up-in-266-of-the-389-metropolitan-areas-in-december-2024.htm

https://get.branchapp.com/resources/2022-branch-report-pdf

https://www.achieve.com/about/press/cash-strapped-americans-regularly-have-less-than-usd50-in-the-bank-achieve-survey-finds

https://www.federalreserve.gov/publications/2024-economic-well-being-of-us-households-in-2023-expenses.htm

https://www.minneapolisfed.org/article/2024/amid-a-resilient-economy-many-americans-arent-ready-for-a-rainy-day

https://www.ft.com/content/5d91cf7d-6c47-4b8c-8400-0d060eb92c8a

https://finance.yahoo.com/news/4-reasons-people-struggle-build-200038239.html

https://www.loqbox.com/en-gb/blog/do-you-have-an-emergency-fund-or-rainy-day-savings

https://www.johnhancock.com/ideas-insights/how-america-spends-rainy-day-fund.html