If you support your loved ones by sending money to an M-Pesa account, you’re like many of your fellow Africans abroad.

Kenyan workers overseas send millions of dollars home each year. Remittances like yours are an important part of the national economy. However, steep wire transfer fees and lopsided exchange rates can make sending money to Kenya expensive. That’s where Remitly comes in.

Sending Money to M-Pesa in 5 Easy Steps

Trying to send funds to family and friends in Kenya? Follow these simple steps to send money safely to an M-Pesa wallet.

- For first-time users, download the Remitly app and create an account. Then select Kenya as your destination country.

- Enter the amount you wish to send.

- Select your delivery speed, then choose Mobile Money as your delivery method and M-Pesa as your location.

- Enter your recipient’s phone number and full name.

- Enter your payment details.

And that’s it! Give your details a quick review and press send. Rest easy knowing your money is on its way across borders.

Your recipient can track the transfer on their end, too. Remitly offers peace of mind for everyone involved.

Why Should I Use Remitly to Send Money to M-Pesa?

With Remitly, it’s super-easy to send money any time and any place using your phone or computer. Our service is very fast. We also offer excellent exchange rates for Kenya and ZERO transfer fees.

Plus, if you need to cancel your transfer for any reason, you will get your money back.

How Quickly Will My Money Arrive?

Using Remitly, sending money to M-Pesa is quick and efficient. Senders that pay with a debit or credit card can transfer money immediately.

If you’re not in a hurry, transfers via bank account take three to five days.

How Much Money Can I Send to M-Pesa with Remitly?

Remitly is dedicated to helping all of its customers send money safely, no matter the quantity they send. We prioritize safety and international regulations to protect your information and your assets.

To follow those rules, Remitly does have sending limits based on the information provided by a customer.

Is It Safe to Send to M-Pesa with Remitly?

In a word: yes. There’s a reason that we have millions of users around the world who trust Remitly.

Remitly uses two-factor verification and personal data encryption to ensure safe logins and secure transactions. You can also turn on SMS/text notifications to keep an eye on your transfer.

If anything goes wrong while sending funds, you’ll get your money back.

Read more about how Remitly keeps you safe in our guide here.

Why Kenyans Love M-Pesa

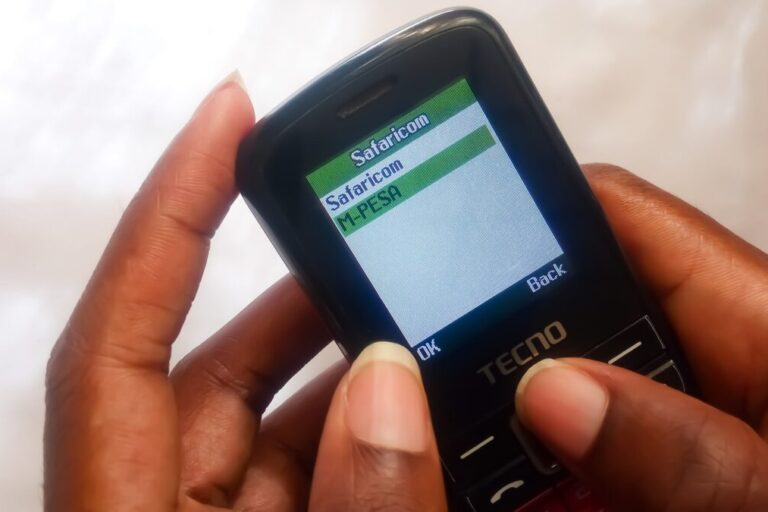

M-Pesa is Africa’s most successful mobile money service. Similar to Apple Pay, the M-Pesa app allows users to store money on their phones securely and use it to pay bills, send and receive funds, and more.

Users like M-Pesa because it’s so convenient. Like other mobile money providers, it turns your phone into a digital wallet. In a country like Kenya, where the majority of the population does not have a formal bank account, an e-wallet like M-Pesa is a lifesaver.

In fact, in Kenya, the service is so popular that 96% of the country has a mobile money account. You can use M-Pesa for cashless transactions but also to get cash by going to an agent at an M-Pesa counter.

While M-Pesa doesn’t allow money transfers outside of Kenya, by using Remitly, you can easily transfer money from outside the country into an M-Pesa mobile wallet.